Explore The Chapters

8. Profitable Chart Patterns Every Trader Needs To Know

9. How To Trade Fibonacci With Price Action

10. How To Trade Trendlines With Price Action

11. How To Trade Moving Averages With Price Action

12. How To Trade Confluence With Price Action

13. Multiple Time Frame Trading

15. Precautions & Conclusion With Price Action Trading

Many new traders that find it difficult to define the structure of a trending market, therefore they rely on moving averages for trend detection or identification.

Using Moving Averages For Dynamic Support And Resistance Levels

The concept of dynamic support and resistance can be fully understood with a few charts given below.

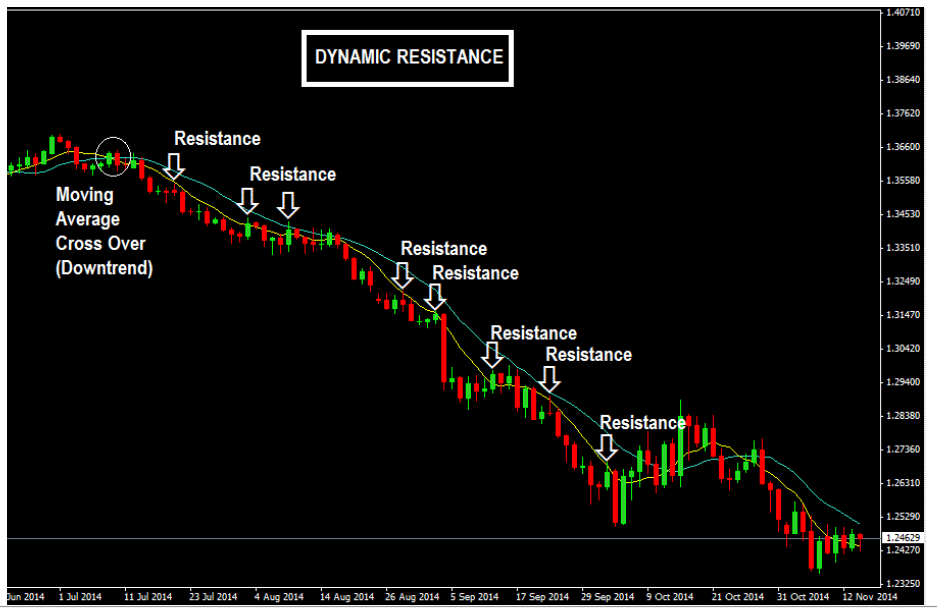

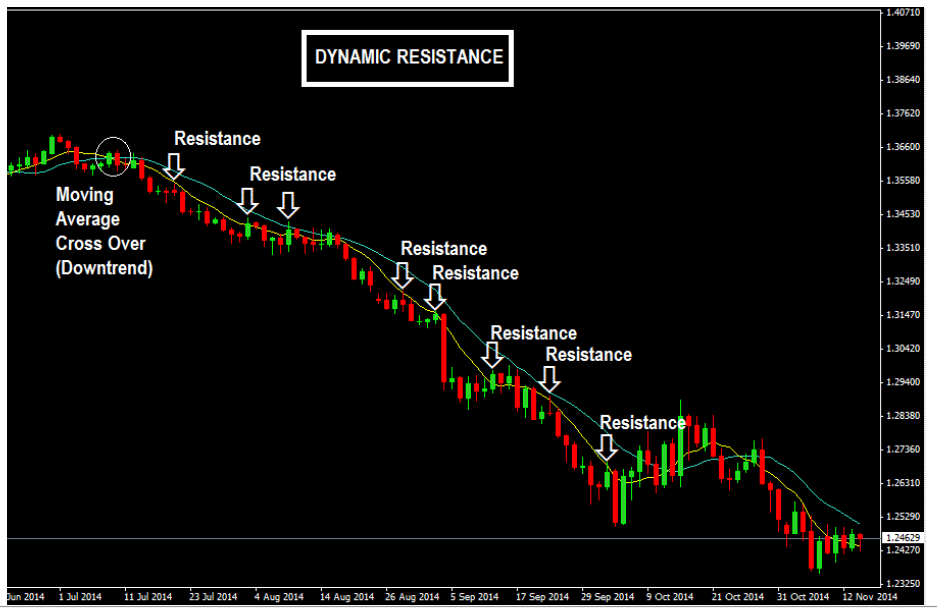

When the market is in a downtrend, you will notice that price moves up to the moving average lines (upswing) and then bounces back down from them (downswing). (That is if you put moving average lines on your charts).

Here’s an example:

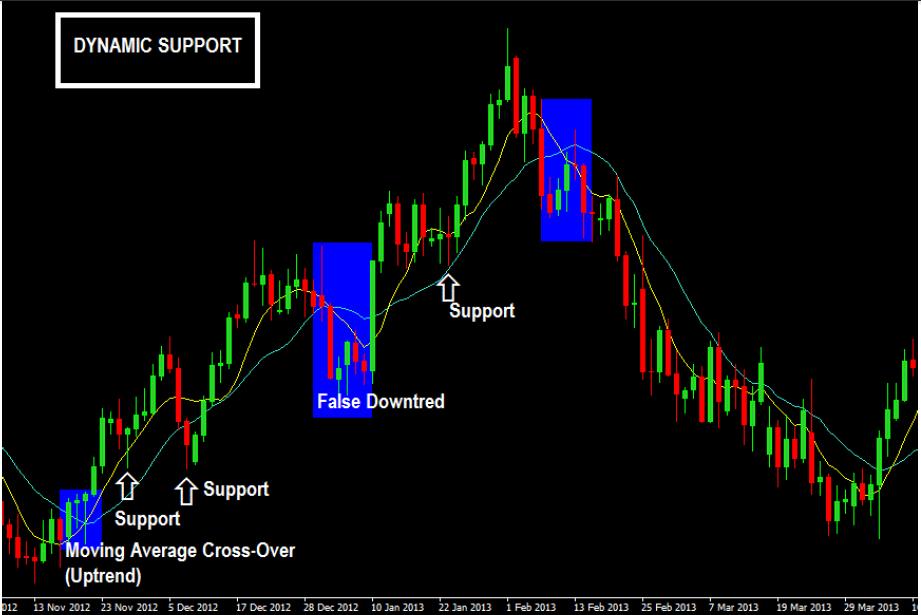

The similar situation happens in an uptrend: prices move down to the moving average lines (downswing) and then bounces up from them (upswing).

Here’s an example shown on the chart below:

Now that you know this concept of dynamic support and resistance using moving averages, the next thing you need to know is that trend trading strategies can be created around them and in a very nice trending market, they are really effective.

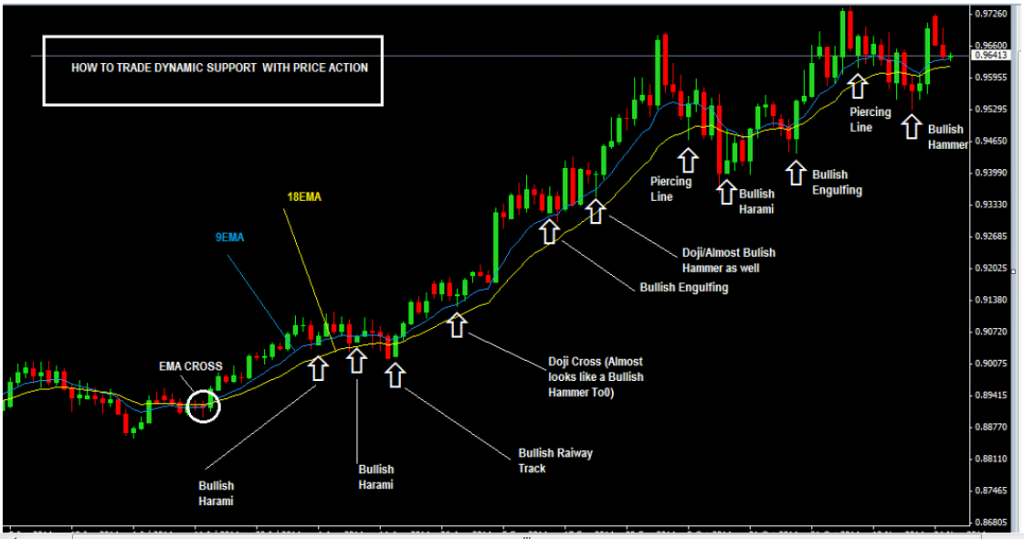

For those that love moving averages, look for reversal candlesticks as the price starts to go back to touch the moving average lines and these are used as your confirmation signal to buy or sell.

- In a downtrend, you should be looking for bearish reversal candlesticks like the shooting star, bearish harami, spinning tops, dark cloud cover, hanging man etc to go short (sell).

- In an uptrend, you should be looking out for bullish reversal candlestick patterns like pin bars, dojis, piercing line, bullish harami etc…

Let’s study the past again…on the chart below is an example of how to trade dynamic support with Price Action:

Now, it’s easy to say here that “ you could have bought here and sold here” etc based on what happened in the past because now you can see how the market has played out in the past…

But real challenge for many traders is that when a setup is happening, they will most likely second guess it because this is how its going to look:

And this is how how it turned out:

This is how you can use trading averages together with price action in forex and synthetic indices trading.

Explore The Chapters In The Price Action Course

Share this using the buttons below

Other Posts You May Be Interested In

How To Transfer Funds From One Deriv Account To Another

It is now possible to transfer funds between two Deriv accounts belonging to two different traders [...]

XM Broker Review (2024): Is XM a Good Broker? ☑️

Overall, this XM can be summerised as a dependable and secure broker, backed by an [...]

HFM Broker Review (2024) ☑️ Is It Trsutworthy?

HFM Overview HFM, previously known as Hotforex was founded in 2010 and has its headquarters [...]

What Is The Difference Between Technical Analysis Vs Fundamental Analysis?

Here are the main differences between technical analysis and fundamental analysis… Technical Analysis: technical analysis [...]

Heikin Ashi Forex Trading Strategy

Heikin-Ashi candles are a variation of Japanese candlesticks and are very useful when used as [...]

How To Trade Moving Averages With Price Action

Many new traders that find it difficult to define the structure of a trending market, [...]