Explore The Chapters

8. Profitable Chart Patterns Every Trader Needs To Know

9. How To Trade Fibonacci With Price Action

10. How To Trade Trendlines With Price Action

11. How To Trade Moving Averages With Price Action

12. How To Trade Confluence With Price Action

13. Multiple Time Frame Trading

15. Precautions & Conclusion With Price Action Trading

Top Forex Brokers For You

What Is Price Action Trading?

Price action is the study of a forex pair's price movement.

To really understand price action means you need to study what happened in the past. You must then observe what is happening in the present and then predict where the market will go next.

All price movement in Forex comes from bulls (buyers) and bears (sellers). The Forex market is ultimately in a constant state of struggle between bulls and bears. Price action trading is about analysing who currently controls price, bulls or bears and if they are likely to stay in control.

Price action trading uses tools like charts patterns, candlestick patterns, trendlines, price bands, market swing structure like upswings and downswings, support and resistance levels, consolidations, Fibonacci retracement levels, pivots etc.

Generally, price action traders tend to ignore the fundamental analysis-the underlying factor that moves the markets. Why? Because they believe everything is already discounted for in the market price.

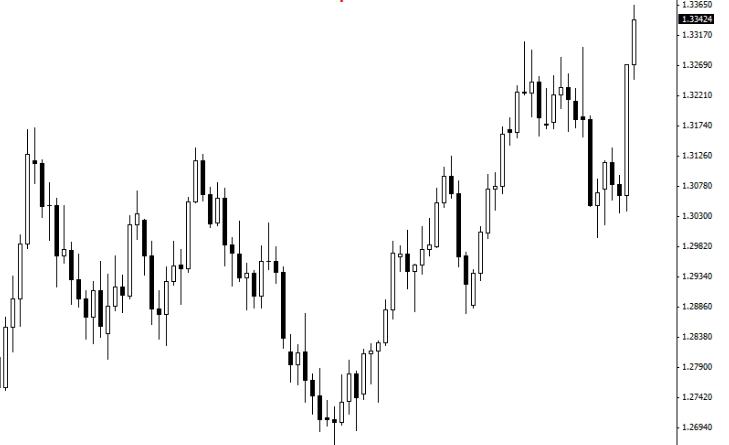

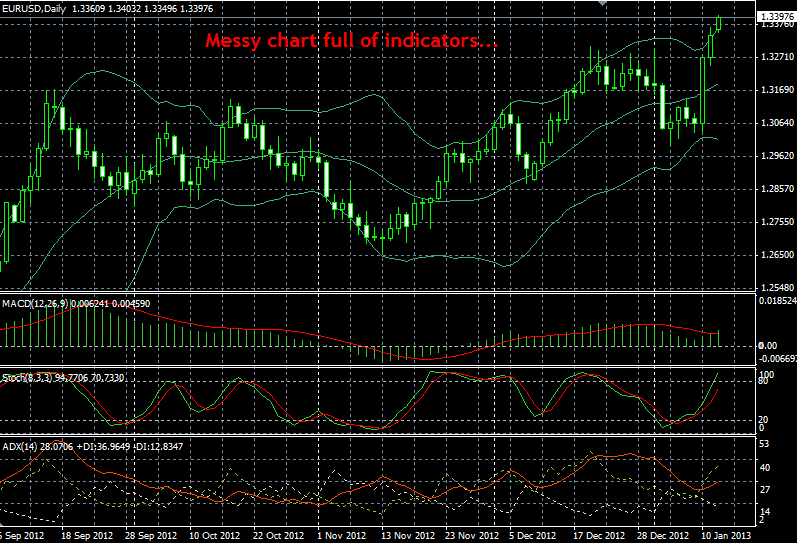

Price action trading uses a clean chart without indicators. Take a look and compare the two charts below.

It’s worth pointing out how in the indicator-laden chart you actually have to give up some room on the chart to have the indicators at the bottom. This forces you to make the price action part of the chart smaller, and it also draws your attention away from the natural price action and onto the indicators. So, not only do you have less screen area to view the price action, but your focus is not totally on the price action of the market like it should be.

If you really look at both of those charts and think about which one is easier to analyze and trade from, the answer should be pretty clear. All of the indicators on the chart below, and indeed almost all indicators, are derived from the underlying price action.

In other words, if you add indicators to your charts you just produce more variables for yourself; you don't gain any insight or predictive clues that aren’t already provided by the market’s raw price action.

Before you get started, these are some words that you may encounter:

Long= buy

Short= sell

Bulls= buyers

Bears= sellers

Bullish=if the market is going up, it is said to be bullish (uptrend).

Bearish=if the market going is down, it’s said to be bearish.

Bearish Candlestick=a candlestick that has opened higher and closed lower is said to be bearish.

Bullish Candlestick=a candlestick that has opened lower and closed higher is said to be a bullish candlestick.

Risk: Reward Ratio=if you risk $50 in a trade to make $150 then your risk: reward is 1:3 which simply means you made 3 times more than you risked. This is an example of risk: reward ratio.

You can learn more about forex terms in the glossary.

Now, the next chapter of the price action trading course, you are going to learn more about what price action is and lots more.

To practice price action you will need to open a forex account and you can choose any broker below to open the free account.

Top Forex Brokers For You

Explore The Chapters In The Price Action Course

Share this using the buttons below

Other Posts You May Be Interested In

Understanding Candlesticks In Trading

The candlestick chart is the most common among traders. The candlestick chart had its origins [...]

Heikin Ashi Forex Trading Strategy

Heikin-Ashi candles are a variation of Japanese candlesticks and are very useful when used as [...]

How To Trade Confluence With Price Action

Confluence refers to a junction of two or more items. For example, the place where [...]

How To Trade Forex On Deriv

Deriv is popular for its unique synthetic indices. But, did you know you can also [...]

Gartley Pattern Forex Trading Strategy

This strategy is based on a pattern called the Gartley pattern. You will need the [...]

How To Trade Support & Resistance Levels

Nothing is more noticeable on any chart than support and resistance levels. These levels stand out and [...]