Overall, this XM can be summerised as a dependable and secure broker, backed by an impressive trust score of 93 out of 99. Offering a welcoming environment for both beginners and experienced traders, XM facilitates easy entry with a low minimum deposit and enriches knowledge through well-researched educational materials. With 24/5 customer support and a user-friendly copy trading option, XM prioritizes seamless and accessible trading experiences for its users.

This XM broker review investigates this highly regulated forex broker with over 10 million happy traders worldwide. The broker, which now serves clients from almost 200 countries, was founded in 2009 and is headquartered in Cyprus.

The reason for such high numbers is that XM strives to provide one of the best user experiences in the industry to its clients. This impressive growth has not gone unnoticed as the broker has scooped several prestigious international awards.

XM Overview

| Broker's Name | XM.com |

| Headquarters | Cyprus |

| Year Founded | 2009 |

| Regulating Authorities | FCA, CYSEC, ASIC, FSC, DFSA |

| Account Types | Micro Account; Standard account; Ultra Low Account; Shares Account |

| Demo Account | Yes |

| Bonus | Yes |

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $5 |

| Fees | from $ 3.5 / R56 ZAR |

| Spreads | spreads from 0.6 to 1.7 pips |

| Commission | commission-free trading depending on the account selected |

| Deposit Options & Withdrawal Options | Bank Wire Transfer, Local Bank Transfer, Credit/Debit Cards, Neteller Skrill, and more. |

| Platforms: | MT4, MT5, XM WebTrader |

| Islamic Account? | Yes |

| Tradable assets offered | Forex, commodities, cryptocurrency, shares, indices, metals, energies, options, bonds, CFDs, and ETFs |

| Customer Support Languages | 27 Languages |

| Countries not accepted for trade | United States |

XM.com accepts more than 25 secure payment methods, offers 16 full feature trading platforms, and 24/5 personal customer service. This XM review found out that more than 99 % of all XM.com orders are executed in less than a second, with no re-quotes or rejections. XM clients benefit from Negative Balance Protection, so they are never at risk of losing more than their account balance.

XM Account Types

This XM review found that XM offers a variety of trading accounts with exceptional trading conditions As an account holder you have the option to trade either with micro or standard lots.

Xm accounts also come with unlimited access to MT4/MT5 and expert advisor trading. You can also be assured of the same execution quality for all account types. XM Minimum Deposit amount is 5$ only for Micro Account or a Standard Account, However, the amount varies according to the chosen payment method and trading account validation status. Below is a breakdown of the different account types offered by XM

| Accounts | XM Micro Account | XM Standard Account | XM Ultra Low Account | XM Shares Account |

| Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | EUR, USD, GBP, AUD, ZAR, SGD | USD |

| Contract Size | 1 Lot = 1,000 | 1 Lot = 100,000 | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 | 1 share |

| Leverage | 1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) | 1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) | 1:1 to 1:100 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) | No Leverage |

| Negative balance protection | yes | yes | yes | yes |

| Spread on all majors | As Low as 1 Pip | As Low as 1 Pip | As Low as 0.6 Pips | As per the underlying exchange |

| Commission | No | No | No | No |

| Maximum open/pending orders per client | 300 Positions | 300 Positions | 300 Positions | 50 Positions |

| Minimum trade volume | 0.1 Lots (MT4) 0.1 Lots (MT5) | 0.01 Lots | Standard Ultra: 0.01 Lots Micro Ultra: 0.1 Lots | 1 Lot |

| Lot restriction per ticket | 100 Lots | 50 Lots | Standard Ultra: 50 Lots Micro Ultra: 100 Lots | Depending on each share |

| Hedging allowed | Yes | Yes | Yes | No |

| Islamic Account | Optional | Optional | Optional | Yes ☑️ |

| Minimum Deposit | 5$ | 5$ | 5$ | 10,000$ |

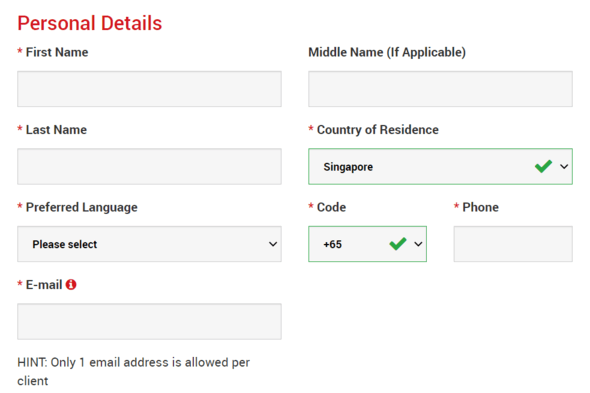

How To Open An XM Real Trading Account

This XM group review found that the account opening process at XM is straightforward. Simply follow the steps below to open your account.

Visit the XM Real Account Registration Page

Click here to get to the XM registration page.Fill in the form

- First Name and Last Name

- They are displayed in your identity document.

- Country of Residence

- The country you reside in may affect the account types, promotions and other service details available for you. In here, you may select the country you currently reside in.

- Preferred Language

- The language preference can be changed later too. By selecting your native language, you will be contact by support staffs who speak your language.

- Phone Number

- You may not need to call to XM, but they may call in some cases.

- Email Address

- Make sure you type in the correct email address. After the completion of the registration, all communications and logins will require your email address.

- First Name and Last Name

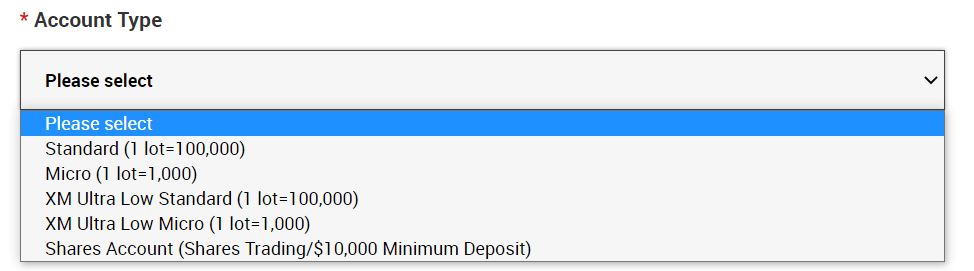

Select your Trading Platform & Account type

Select the trading platform you would like to use between MT4 and MT5. Next, choose the account type you would like to open from the range of accounts offered by XM group. You can learn more about the different accounts here.

Agree to the terms and conditions and proceed to the next step.Fill In Further Personal Details

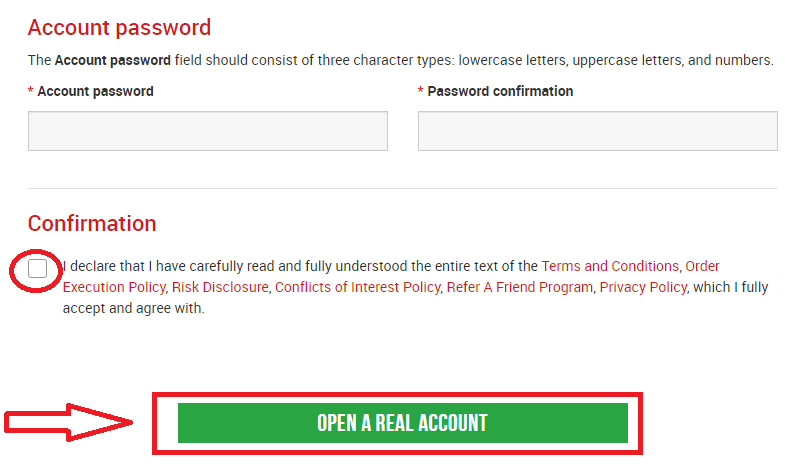

On the next page, you will need to fill in some more details about yourself and your investment knowledge. You will also get to set your account password. Make sure you choose a password you will not forget so that you will not be locked out of your account.

Accept the terms and conditions and click on ‘OPEN REAL ACCOUNT‘ as shown above.Confirm Your Email

You will need to confirm your account by pressing where it says “Confirm email address“ in the email sent to you by XM. Upon confirmation of the email and account, a new browser tab will open with welcome information. The identification or user number that you can use on the MT4 or Webtrader platform is also provided. You will also get an email with your login details.

You can then log in and start trading as you would have successfully created your real XM trading account.

Which Instruments Can You Trade On XM?

This XM broker review found that clients can trade more than 1000 instruments anytime and anywhere. These include:

- CFDs on Forex, Shares, Indices, Commodities, Metals, and Energies

- Forex Trading on 55+ global currency Pairs

- CFDs on Indices – Major global indices

- Commodities CFDs – Sugar, cocoa, wheat, and more

- CFDs on Stocks – Over 600 companies

- CFDs on Metals – Gold, Silver, Palladium, and more

- CFDs on Energies – Oil, Gas and all major energies.

XM Broker Review: Deposit and Withdrawal Methods

XM.com offer a variety of payment methods for clients to fund their accounts: These include: Credit cards, Bank Transfer, Payoneer, Neteller, and UnionPay. This XM broker review found that Xm allows deposits to be made in any currency. However, they will be automatically converted into the base currency that the client chose when they opened the account. All withdrawals are processed within 24 hours and users of XM Card or any eWallet methods will receive their money on the same day the request has been processed. Wire Transfer and credit or debit card users will have to wait 2-5 working days. The minimum deposit and withdrawal amount is $5. To withdraw funds from XM simply click the “Withdrawal” button on the My Account page. After logging in to your account, click “Withdrawal” on the menu, and select the withdrawal method similar to the deposit method you used. Enter the amount you wish to withdraw and submit.

XM Broker Review Pros and Cons

| Pros | Cons |

| Licensed and Regulated (ASIC, Cyprus Securities and Exchange Commission & IFSC)No banking license | No banking licence |

| Tight spreads available | Increased spreads on the Micro and Standard accounts |

| 55+ Currency pairs to trade with | No 24/7 Customer support |

Is XM Legit Or A Scam?

No, XM is not a scam. We consider XM a safe broker to trade Forex and CFDs. It is regulated and licensed by several top-tier financial authorities including FCA, Cyprus Securities and Exchange Commission (Reg. – CySec 120/10), Australian Securities and Investments Commission (Reg. – ASIC 443670), and International Financial Services Commission (Reg. – IFSC/60/354/TS/19).

Is XM a reliable broker?

Yes, XM is a reliable broker with world-class trading technologies and educational resources. Over 5 million happy traders worldwide have chosen XM because of its reliability and trustworthiness.

Is XM forex broker good for beginners?

Yes definitely. XM is one of the best forex service providers. XM Group has a low minimum deposit, good customer service, an excellent web & mobile trading platform, low fees, great educational tools, and an easy account opening process. So based on these features, we can say that XM is suitable for beginners.

XM Broker Review: Customer Support

According to our XM broker review, XM.offers offer 24/5 hour live help by a professional Customer Support department. Support is provided in 28 languages making it very convenient for clients from all over the globe. A comprehensive FAQ page provides you with guidance and answers at any time and within minutes. If you can't find answers on this FAQ page, you can contact XM.com via their email address or live chat.

XM Broker Review: Education

XM is committed to the success of its clients. To this end, it provides a comprehensive learning section designed for both beginner and expert forex traders. Every XM client can access numerous educational materials through XM Learning Center. The centre has resources that include Live Education offerings, Educational Videos, Forex Webinars and regularly held Forex Seminars in various destinations. In addition, there are very well-organized tutorials, videos and tools at your disposal.

The Primary video series is free to view by everyone interested in online trading, while access to the Intermediate video tutorials is only available for clients with a real XM account.

Visit XM Learning CentreXM Broker Review: Verdict

XM Broker can be safely recommended to those who are interested in professional trading with high order processing speed and an optimal level of commission. The high number of trading instruments offered (1000+) makes it very convenient for traders. One of the biggest drawbacks of the broker is that it does not offer crypto trading. The trading platform is easy to use, the fees are generally attractive and the level of flexibility on offer is appealing.

Reliability ⭐⭐⭐⭐

Platform ⭐⭐⭐⭐

Commissions ⭐⭐⭐⭐

Support ⭐⭐⭐⭐

Financial instruments ⭐⭐⭐⭐

RATING: 4.3

Other Posts You May Be Interested In

Brokers Offering Copy & Social Trading

Are you looking for the best list of copy trading platforms? Then look no further [...]

How To Trade Forex On Deriv

Deriv is popular for its unique synthetic indices. But, did you know you can also [...]

How To Trade Support & Resistance Levels

Nothing is more noticeable on any chart than support and resistance levels. These levels stand out and [...]

Inside Bar Forex Trading Strategy

The inside bar forex trading strategy can be classified as a simple price action trading [...]

List Of Forex Brokers That Accept Airtm (2024)

AirTm has become one of the preferred methods to fund and withdraw from trading accounts [...]

Forex Forecast Week 26/23

Week 26/22 Forecast Where art thou bound, DXY? This is a very short-form analysis that [...]