If you are a housewife forex trader or somebody who does not spend a lot of time in front of your trading charts because of work, this may be the only forex strategy you need as it can be a set and forget type of trading system.

The inside bar forex trading strategy has no need for other forex indicators as it is purely a trading method based on price action.

Currency Pair: Any

Timeframes: Preferably the 4hr and the daily timeframes

Forex Indicators: None

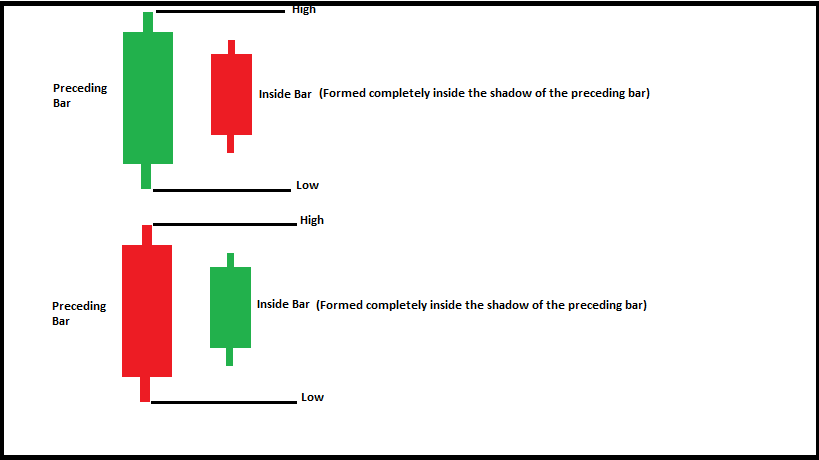

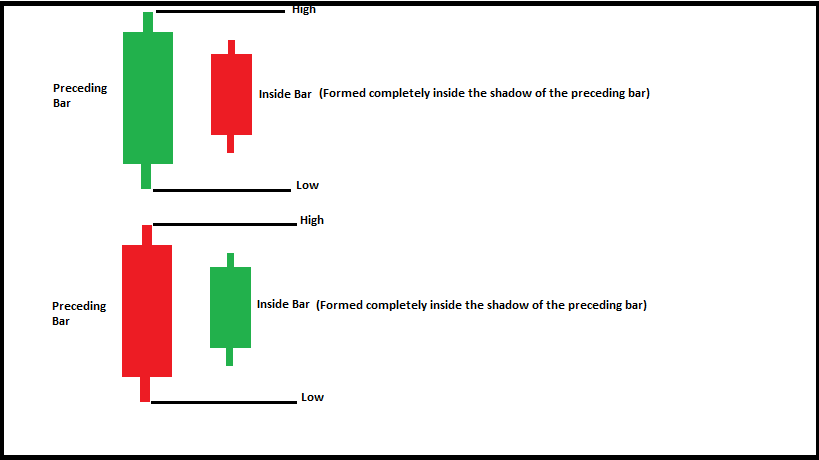

WHAT IS AN INSIDE BAR?

An inside bar is a 2 candlestick formation. The first candlestick that forms may be called the “mother candlestick”

The second candlestick that forms after the “mother candlestick” is engulfed completely within the shadows of the mother candlestick. That second candlestick is called the “inside bar.

Here’s an example of what inside bar candlestick formation looks like:

notice on the chart above:

- the inside bar is completely engulfed within the shadows of the highs and lows of the preceding bar (or candlestick)

- it is a two-candlestick pattern formation

- the preceding candlestick can be either a bullish or bearish bar (candlestick).

- the inside bar itself can be a bullish or bearish candlestick.

WHY DO INSIDE BARS FORM?

Inside bars, when they form show a time period of market consolidation. This market consolidation can be due to:

- a time of indecision as traders are figuring out if they are going to buy or sell or not

- a period of low trading activity (low trading volume)

- it can also be a time where the bulls and bears of market forces are also almost of equal strength and each really don’t know what direction to take on their trades.

Where Do Inside Bars Form?

Well, inside bars can form anywhere. But the inside bars that are of significance that many traders take notice of must form on these level(areas) listed below:

- support and resistance areas

- pivots

- Fibonacci levels

- trend line touch areas

It's best to only pay attention to inside bars that form in the price levels listed above.

INSIDE BAR FOREX TRADING STRATEGY RULES

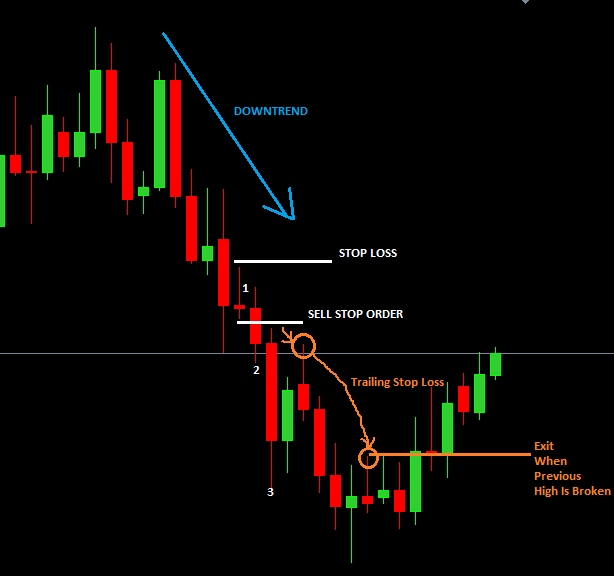

Selling Rules:

- the market must be in a downtrend.

- when you see an inside bar form, then place a sell-stop order anywhere from 2-3 pips below the low of the inside bar. You do that soon as that inside bar closes.

- For Stop loss, place it anywhere from 5-10 pips above the high of the inside bar.

- exit on the close of the third candlestick-your candlestick count should include the inside bar(which should be number 1). The chart below should make this concept clear.

- Or another way for you to exit a trade is to trail stop your trade and lock your profits as the trade moves in your favour until price reverses and takes out your trailing stop loss and hopefully you walk away with a lot more profits compared to exiting on the 3rd candle:

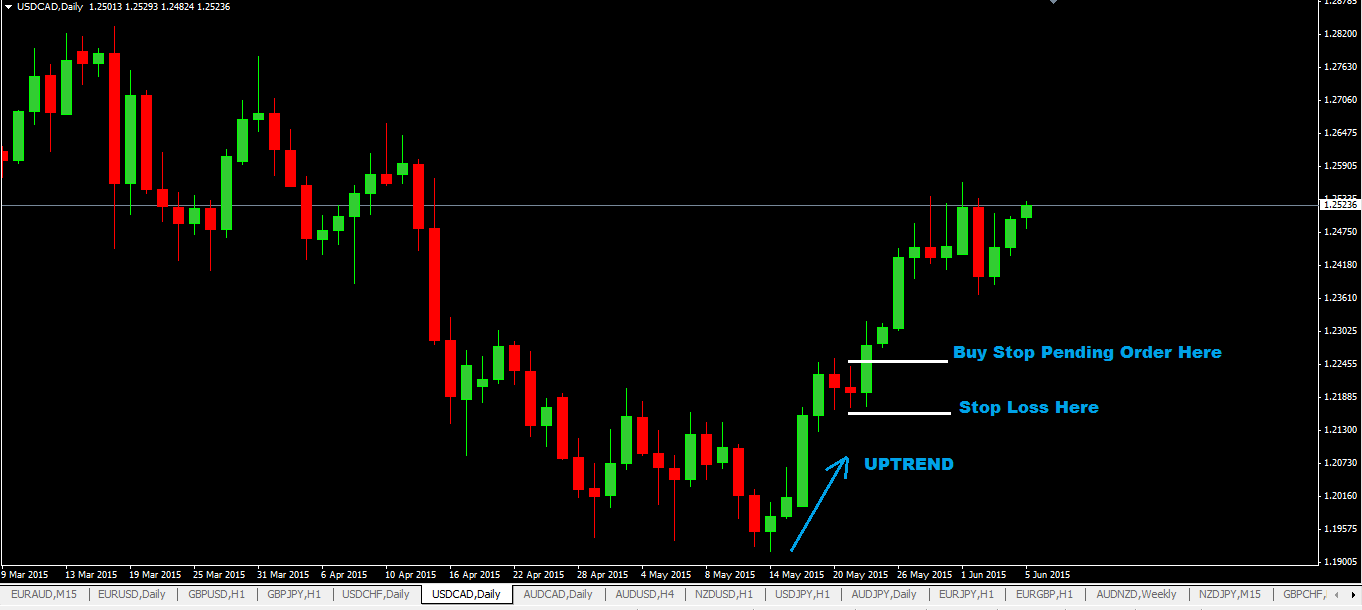

Buying Rules:

The buying rules for the inside bar trading strategy are just the exact opposite of the selling rules. Here they are:

- the market must be in an uptrend.

- when you see an inside bar form, then place a buy-stop order anywhere from 2-3 pips above the high of the inside bar. You do that soon as that inside bar closes.

- For Stop loss, place it anywhere from 5-10 pips below the low of the inside bar.

- exit on the close of the third candlestick-your candlestick count should include the inside bar(which should be number 1). The chart below should make this concept clear.

- Or another way for you to exit a trade is to trail stop your trade and lock your profits as the trade moves in your favour until the price reverses and takes out your trailing stop loss and hopefully, you walk away with a lot more profits compared to exiting on the 3rd candle

AN ALTERNATIVE WAY TO TRADE THE INSIDE BAR

There’s another way to trade the inside bar. It is when you really don’t care if the price is going to go up or down. It's a non-directional trading system.

What you do is place a pending buy stop and sell stop order on both sides of the inside bar…so if the price goes up or down, one of these pending orders is sure to get filled/activated. Here’s how to do it:

- when you see an inside bar form, then you place a pending buy stop order above the high of that inside bar and also place a stop loss below the low of that inside bar. You also need to place a sell stop pending order on the low of the inside bar and place its stop loss above the high of that inside bar.

- if one pending order is activated, you immediately cancel the other that has not been activated.

- For exit and take profits, you can use the techniques given above.

DISADVANTAGES OF THE INSIDE BAR FOREX TRADING STRATEGY

- false breakouts do happen and you will get stopped out as price reverses and hits your stop loss.

- avoid trying to use smaller timeframes to trade inside bars, there will be too many “noise” and false signals

ADVANTAGES OF THE INSIDE BAR FOREX TRADING STRATEGY

- pure price action trading just like the pin bar strategy.

- if you trail stop your trades to lock in profit as shown in the previous chart above, you can make a lot of profit if the trend is strong.

- if you trade using the daily chart, you need only a few minutes each day to check your chart, place your pending order (when you spot an inside bar) and walk away. Check later during the day to see which pending order was activated then cancel the other that was not activated.

- It's a very easy candlestick pattern to spot, even a housewife who has no prior experience in trading forex can use this system and make money trading forex.

Other Posts You May Be Interested In

How To Trade Synthetic Indices: A Comprehensive Guide For 2024

Synthetic Indices have been traded for over 10 years with a proven track record for [...]

1. Introduction To Price Action

What Is Price Action Trading? Price action is the study of a forex pair's price [...]

FBS Broker Review. All You Need To Know ☑️ (2024)

FBS is an online broker that offers financial market trading in forex and CFDs. This [...]

How To Trade Confluence With Price Action

Confluence refers to a junction of two or more items. For example, the place where [...]

Forex Correlation Strategy

This forex correlation strategy is based on Currency Correlation. WHAT IS CURRENCY CORRELATION? Currency correlation is a behaviour [...]

Forex Forecast Week 26/23

Week 26/22 Forecast Where art thou bound, DXY? This is a very short-form analysis that [...]