Week 26/22 Forecast

Where art thou bound, DXY?

This is a very short-form analysis that solely looks at DXY (Dollar index).

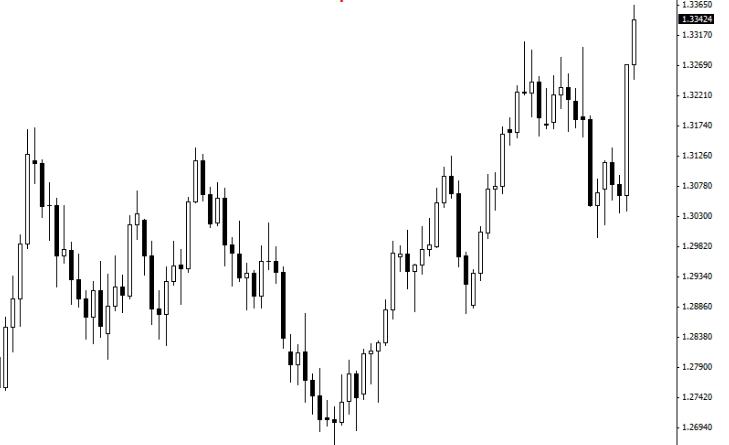

I believe that by studying how DXY may possibly trade, it’s the easiest way for anyone dabbling in the financial markets, with a half-decent grasp of the candlestick charts, to trade XXXUSD & USDXXX pairs seductively.

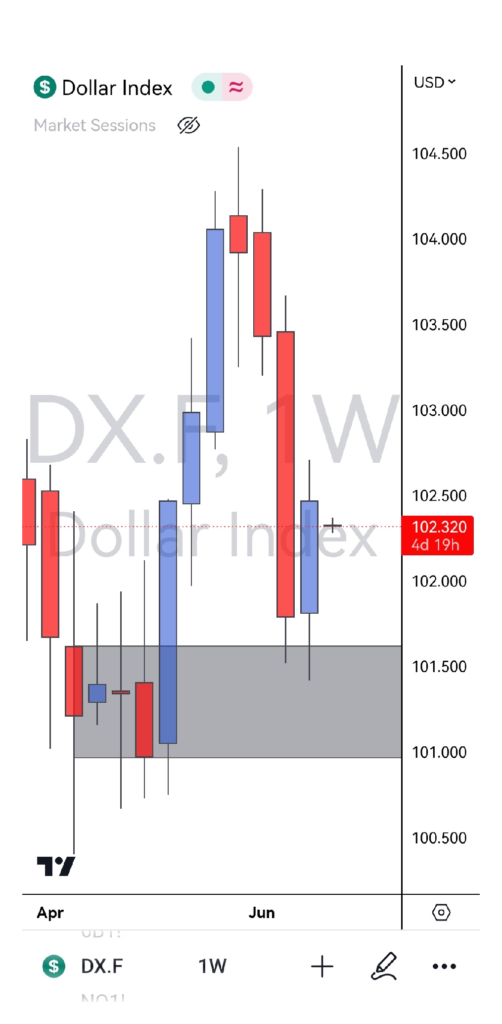

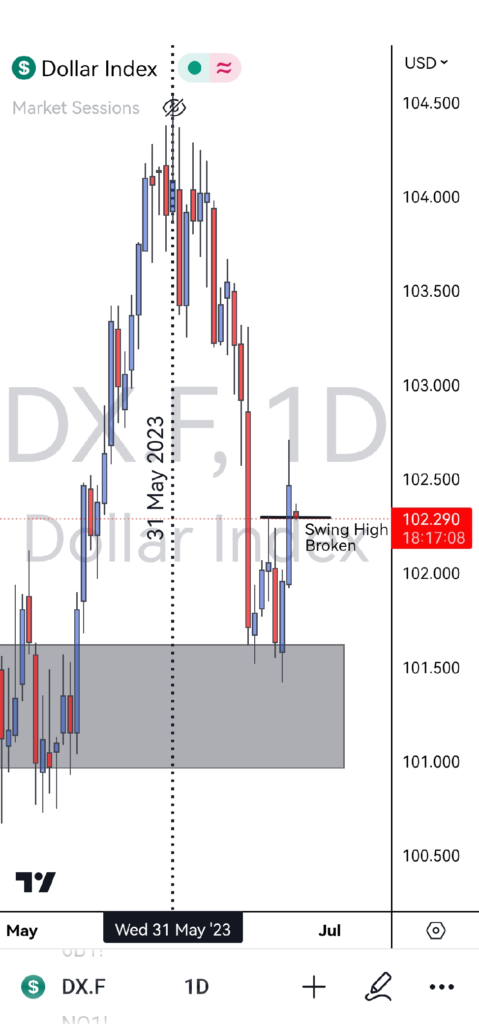

Observe how, since May 31st, DXY has been in a downtrend, selling off from a high of 104.50 to 101.50 which one can argue is an area of Weekly Demand.

For the most part of last week (Week#25), it seems both sides of the market were tussling for dominance as price was pretty much held in consolidation above the 101.50 Demand zone.

It was only on the final trading day of the week, Friday, when buyers bared their knuckles, quickly shooting price upwards.

This frantic buying caused a Market Structure Break along with a Full Body Daily Candle Close above previous swing high. This configuration, for me, formally ends the 3 week-long downtrend.

Unless we see DXY post fresh daily lows with sellers finding acceptance below 101.50, this price action pattern may be hinting towards a market reversal and the beginning of new downtrends & uptrends in XXXUSD & USDXXX pairs, respectively.

Per usual, I shall be investigating the intraday time frames for confirmation/invalidation of this macro trading plan.

Other Posts You May Be Interested In

MT4 Order Types

There are different MT4 order types like buy stop, sell stop, sell limit, buy limit, [...]

Understanding Candlesticks In Trading

The candlestick chart is the most common among traders. The candlestick chart had its origins [...]

XM Broker Review (2024): Is XM a Good Broker? ☑️

Overall, this XM can be summerised as a dependable and secure broker, backed by an [...]

How To Trade Fibonacci With Price Action

Fibonacci retracement levels were discovered by an Italian mathematician by the name of Leonardo Fibonacci [...]

Brokers Offering Copy & Social Trading

Are you looking for the best list of copy trading platforms? Then look no further [...]

How To Make Money Without Trading As Deriv Affiliate Partner

Do you know you can earn up to 45% lifetime commission on Deriv without placing any [...]