Stop-loss orders and take-profit orders are a very critical part of trading. In fact, they should be part of your exit strategy in your trading plan.

Before you take any trade you must already know where you will exit that trade either in profit or loss. Stop loss and take profit orders are the exits that you should use. In this post, we will first look at stop-loss orders and in the second post, we will discuss take profit levels.

In this article, we will help you understand:

- what stop-loss orders are

- why you should use stop-loss orders religiously (advantages of using stop-loss order)

- disadvantages of using stop-loss orders

- where to place stop-loss orders on your charts.

- types of stop-loss orders

- when to move your stop loss level to break-even/entry point

- how to place stop-loss orders on MT4/5 both on mobile and on pc

What is a Stop-loss Order?

A stop-loss order is a pending order placed with a forex broker to exit a trade when the currency pair reaches a certain price in order to limit a forex trader’s loss in a trade.

Stop-loss orders are pending orders i.e they are placed ahead of time.

Why Should You Trade With Stop-Loss Orders?

Stop-loss orders are an extremely important part of the forex money management (or forex trading risk management) process.

Every trade that you take should have a stop-loss order as part of your risk management. Unfortunately, many amateur traders make the mistake of trading without stop-loss orders leading to blown trading accounts and massive frustration.

Below are some of the advantages of always trading with stop-loss orders.

stop-loss orders limit your losses when the trade goes against you.

- No trading strategy is 100% accurate (including such strategies as high probability strategies price action and swing trading). Even banks and professional hedge fund traders suffer losses from time to time.

- Trading with stop-loss orders takes this fact into consideration. The stop-loss order ensures that your account doesn’t get blown as the trade goes against you. Without the order, you would either get out of a bad trade by; manually closing the trade or by getting a margin call from your broker.

-

stop-loss orders take out the emotional aspect of trading

Stop-loss orders are best placed before you get into the trade i.e before you have any emotional attachment to the trade. This al that you choose the most logical placement of the stop-loss order and this is to your advantage.

You are bound to hold on to losses well past the logical level if you do not have a stop-loss in place and the trade goes against you. This is because you will keep hoping the trade will turn around and go in your direction.

Chances are, this has happened to you already.

-

stop-loss orders remove the need to continually check your trades

If you trade without a stop-loss you are bound to be checking your trades every now and then. This will be out of fear of blowing your account should the trade go against you.

The danger in continually checking your trades is that you are more likely to make irrational and compulsive decisions that work against you in the long run. This can lead to sleepless nights as you keep your eye on your trades. With a stop loss in place, you can sleep easy and you can afford to ‘set and forget’ your trades.

stop-loss orders help you determine if you should take the trade or not

The placement of your stop-loss order helps you to determine the risk-reward ratio of that particular trade before entering the trade. If the ratio is too low, or less than one, you may decide not to take the trade in the first place.

You lose this advantage if you open your trade and then look for areas to set your stop-loss afterwards.

Disadvantages of Trading With Stop Loss Orders

There are some downsides to trading with stop-losses that you need to take into account.

- An incorrectly-placed stop-loss order will cost you profits

A tight stop-loss i.e one that’s placed too close to the entry price can lead to premature exits. This is where the trade initially goes against you, triggers your stop loss, and then it goes in your direction without you.

This is very frustrating and if you have used stop-losses for any period of time then you probably have come across such a situation. This also commonly happens in times of great market volatility e.g during fundamental announcements. It is also a common occurrence when trading synthetic indices like V75.

On the other hand, setting your stop loss too far away to accommodate these whipsaws will amplify your losses or expose a big chunk of your profits to the market.

The scenario above is sometimes called the Trailing Stop Dilemma (TTSD) and it’s a real challenge for many traders.

- The market may fail to trigger your stop-loss order during times of very high volatility

Sometimes the market may move so fast that your stop loss is not triggered and you end up losing more than you had planned to risk on that trade. This does not happen often though.

How To Determine Where To Set Your Stop-Loss Orders

Choosing where to set your stop-loss order is a tricky affair most times. Generally, you set your stop loss below the entry price for a long (buy) trade as shown below.

More specifically, your stop loss level placement depends on your trading strategy eg whether you are trading support & resistance strategy, trendline strategy, or chart patterns etc.

It would be tedious to list all the possible areas to put your stop-loss orders for all the strategies listed on this site. You will have to learn about your chosen strategy and how to trade it.

How To Set Stop-Loss Levels When Trading Support & Resistance Levels

First set your support and resistance levels by mapping out the areas on the chart where the price bounces off.

Then enter the trade when the price returns to this level and you get a reversal pattern. Next, you set your stop loss at a level outside of the support (buy trades) or resistance (sell trades).

Set your stop loss at such a level that would mean that either the support and resistance has been broken. This would mean that your trade idea has been invalidated and you need to exit the trade.

Take into account, though, that there may be false breaks and factor this into your stop-loss level distance.

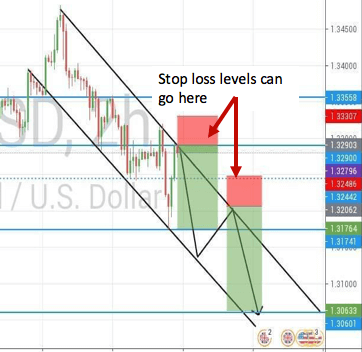

How To Set Stop-Loss Levels When Trading Trending Markets

Here you want to set your stop-loss levels at a position that would mean that the trendline channel has been broken.

Types Of Stop-Loss Orders

There are a number of types of stop-loss orders. Let’s discuss them in detail below.

The ”Set And Forget” Or ‘Hands Off’ Stop-Loss Strategy

This strategy involves just setting your stop loss at the outset and letting the market run its course. You don’t change its position at any point and you will only exit the trade once either:

- the stop-loss is hit (losing trade)

- or the take-profit is hit (winning trade)

Even if your trade gets into profit you do not move the stop loss. This is why it is called a ‘hands-off’ strategy because you can set it and walk away from your charts.

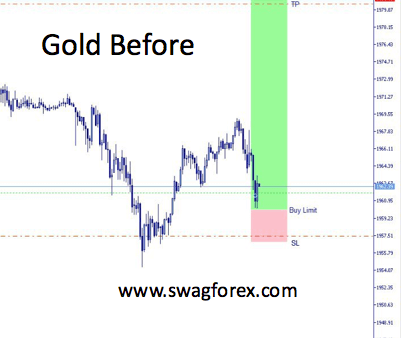

The strategy is advantageous because it removes the emotional aspect from trading right from the get-go. See an example of the set and forget stop-loss in action below.

The stop-loss and take profit levels were set before the trade was entered and were untouched throughout the trade.

One disadvantage of this strategy, though, is that if the trade goes your way your profits will be exposed to the market before take-profit is hit. Should the market reverse before take-profit is hit then a trade that had huge profits at some point will then end up being a losing trade.

See this illustrated in the image of the gold trade shown above.

Would you be able to keep holding the trade with such profits and still be exposed to the risk of the market turning and hitting your stop-loss?

One way to counter this disadvantage is to change the type of stop-loss from a fixed one to a fluid one.

The Trailing Stop-Loss Strategy

The Automatic Trailing Stop-Loss Strategy

This type of stop-loss allows you to protect your profits by choosing a stop loss distance that you are comfortable with and following the price as it goes in your favour.

The automatic trailing stop will not work if your trade is in a loss. See the video below for a visual explanation.

The trailing stop will always expose your predefined number of pips to the market.

The Manual Trailing Stop-Loss Strategy

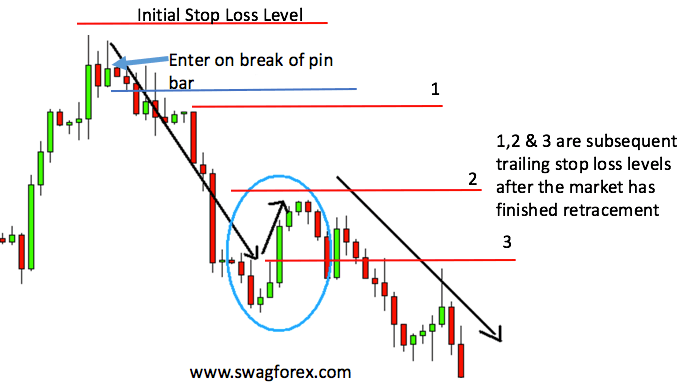

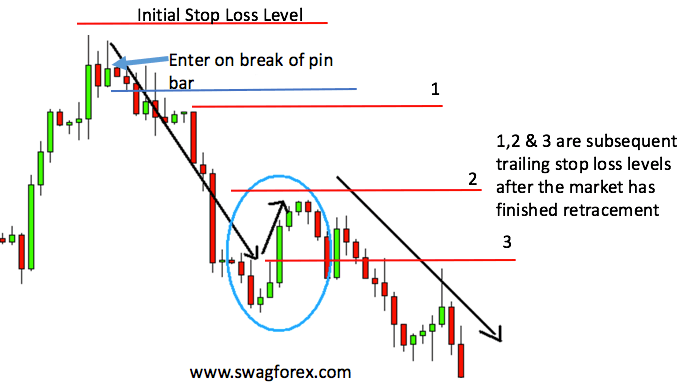

You use this type of trailing stop-loss by manually moving the stop level after the market retraces and then continues on your way. The market doesn’t move in a straight line, but rather it will have periods where it retraces and seems to be going against the current, dominant trend.

After the retracement is over the market continues again in the direction of the main trend and you can use these ebbs and flows to adjust your trailing stop-loss.

The trade would have gone in your favour and you would have moved your stop-loss from its initial position down to levels 1,2 and 3 till the market reverses and stops you out.

This kind of trailing stop loss can let you ride a trend for a long time resulting in huge profits.

See another example of this trailing stop-loss in action this time on an uptrend trade below.

See How We Used This Strategy In This 2R Trade That Hit Take Profit

Disadvantages of The Manual Trailing Stop-Loss Strategy

One tricky part of this trailing stop strategy is that you will always have some profits exposed to the market through the trade. Sometimes the market may move a substantial distance before retracing and you may miss out on the pips involved should the market then completely reverse.

However, you can’t milk the very last pip of any trade and this means you will have some profits exposed to the markets either way.

Another thing you should be aware of is that different timeframes lead to different gains in the same trade. This is because lower timeframes generally tend to have more retracements and whipsaws than larger timeframes.

Let’s look at the same trade using the same trailing stop strategy across three different timeframes.

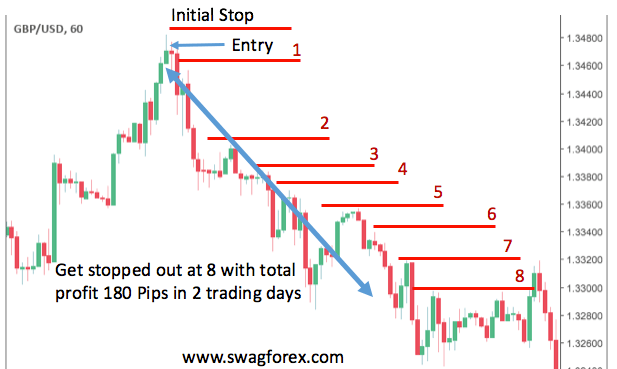

Manual Trailing Stop-Loss on the Hour Chart

You would need to move your stop loss level eight times before it got hit and you exited the trade with 180 pips profit.

Your initial stop loss would have been 30 pips away. The risk: reward ratio would have been 1:6 or 6R.

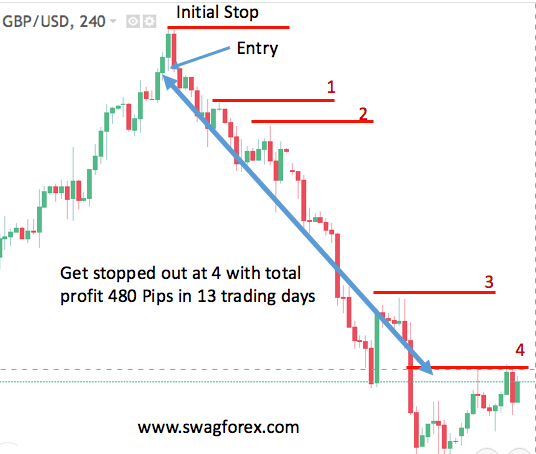

Manual Trailing Stop-Loss on the Four-Hour Chart

Now you would have lasted 9 days in the trade and you would have grossed a massive 480 pips. Your initial stop-loss would have been 90 pips away. Your risk: reward ratio would have been 1:5.3 or 5.3R.

You would also have moved your stop-loss just 4 times as they would have been fewer whipsaws on this chart.

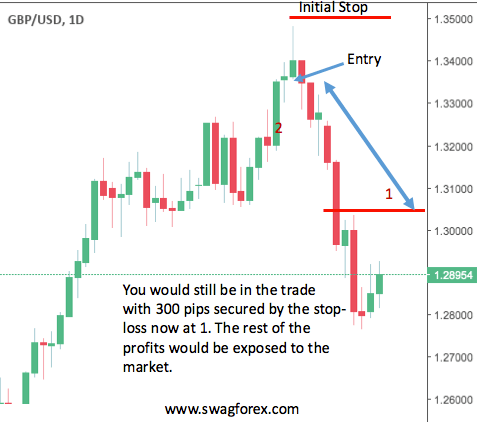

Manual Trailing Stop-Loss on the Daily Chart

You would have moved your stop-loss just once in 10 trading days. During that time, your trade would have gone as much as 500 pips in profit but you would have left them all exposed to the market whilst waiting for that pullback and continuation.

Your initial stop-loss level would have been 140 pips away and you would have carried this risk until the close of the seventh candle.

The trade would still be ongoing and can eventually reach 1000+ pips.

This is where it gets tricky. Larger timeframes, whilst promising better returns, also have longer risk exposure times, expose a bigger chunk of the profits to the markets, have wider stop-losses. Trades taken on larger timeframes usually take very long to play out.

You need a lot of patience, discipline and equity for you to use this strategy on the larger timeframes.

Testing the Manual Trailing Stop-Loss Strategy For Yourself

- Take the first trade on the hour chart and trail your stops using that chart

- Then you take the second position on the 4H chart and manage the trade using that chart as well

- Your third position is taken on the daily and managed using the same chart

- The final position is taken using the multi-timeframe trading strategy and managed using the same strategy of moving trailing stop-loss.

At the end, you want to see for yourself how stop-losses, risk and profits differ between these 4 trades. You can then make an informed decision & use the best strategy in your live account.

This stop-loss strategy is less suited for trading synthetic or volatility indices like volatility 75 and volatility 100 due to their extremely volatile nature. You would have to expose a significant pip value to the market and this may work against you.

Conclusive Remarks on Using Stop-Loss Orders

You now appreciate the fact that stop-loss orders should be used in every trade that you take. Each trade will always be different and your knowledge of the different stop-loss strategies should help you choose the appropriate one for the different circumstances.

We would advise you to extensively test out these different stop-loss strategies on a demo account before trying them out on real accounts so that you do not have nasty surprises.

Also, remember that you cant get every last pip out of a trade. Fortunately, you don’t even need to do that to become a consistently profitable trader.

Strive to keep a good risk: reward ratio and religiously use your stop losses and you will become a better trader over time.

Other Posts You May Be Interested In

Comprehensive Guide To Trading With Stop-Loss Orders

Stop-loss orders and take-profit orders are a very critical part of trading. In fact, they [...]

Heikin Ashi Forex Trading Strategy

Heikin-Ashi candles are a variation of Japanese candlesticks and are very useful when used as [...]

How To Trade Moving Averages With Price Action

Many new traders that find it difficult to define the structure of a trending market, [...]

Gartley Pattern Forex Trading Strategy

This strategy is based on a pattern called the Gartley pattern. You will need the [...]

How To Trade Trendlines With Price Action

What is a trending market? It is a market with a strong bias towards one [...]

Pin Bar Forex Trading Strategy

The Pin Bar Forex Trading Strategy is a great trading strategy for trend trading: If [...]