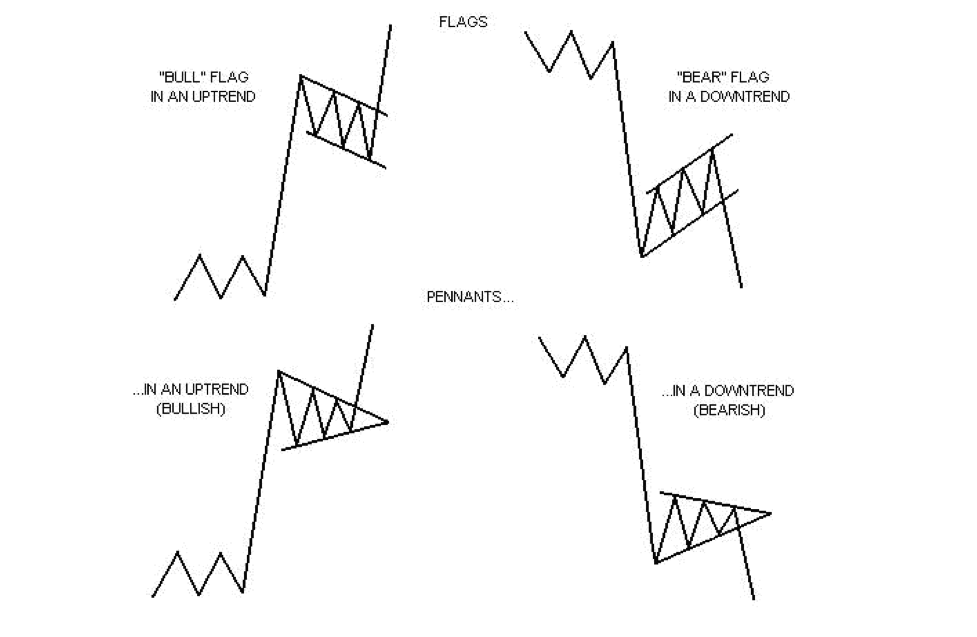

Flags and pennants are popular continuation patterns that every trader must know. Flags and pennants closely resemble each other, differing only in their shape during the pattern's consolidation period. These patterns are usually preceded by a sharp rally or decline with heavy volume, and mark a midpoint of the move.

Flags and Pennants patterns closely resemble each other, differing only in their shape during the pattern's consolidation period. This is the reason the terms flag and pennant are often used interchangeably.

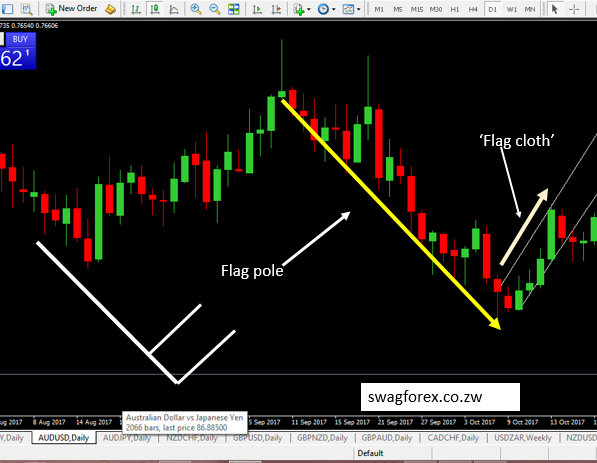

Flags in Forex Trading

What is a flag in trading?

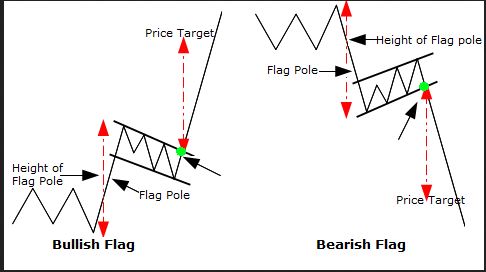

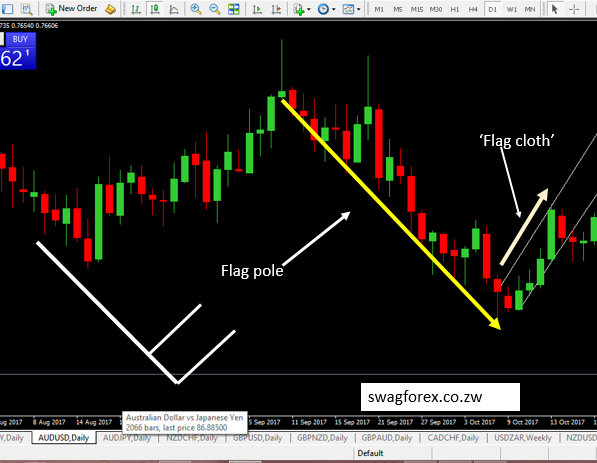

A flag is a pattern that consists of a channel of parallel trend lines that go against the previous trend. If the previous move was up, then the flag would slope down. If the move was down, then the flag would slope up.

As you can see, the flag really looks like our everyday physical flag. The pole will be the beginning of the trend, either up or down. The ‘flag cloth' would represent the period of consolidation before the trend picks up again.

A bullish flag would just be the opposite, going up.

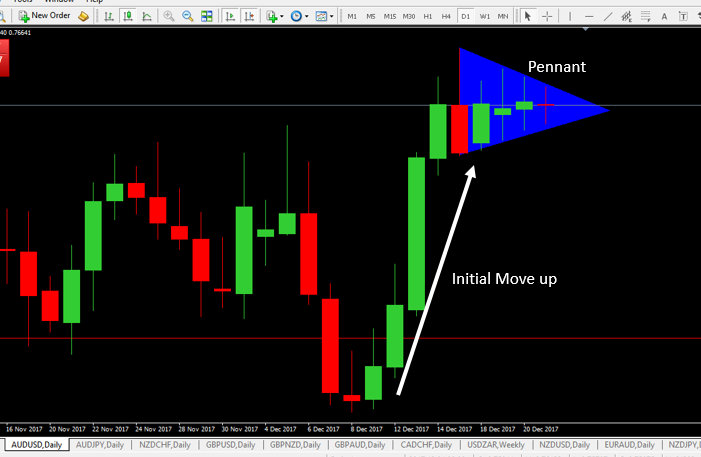

What is a pennant in Forex trading

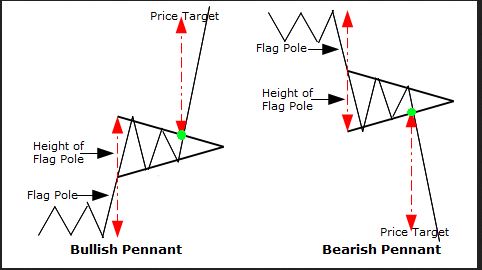

A pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone).

The symmetrical triangle shows an area where the market was consolidating before picking up again.

How to trade Flags and Pennants

You can enter at the break of the flag/pennant in the direction of the preceding trend. Sometimes the market tends to retest the broken pattern so you need to be aware of that when you set your stops.

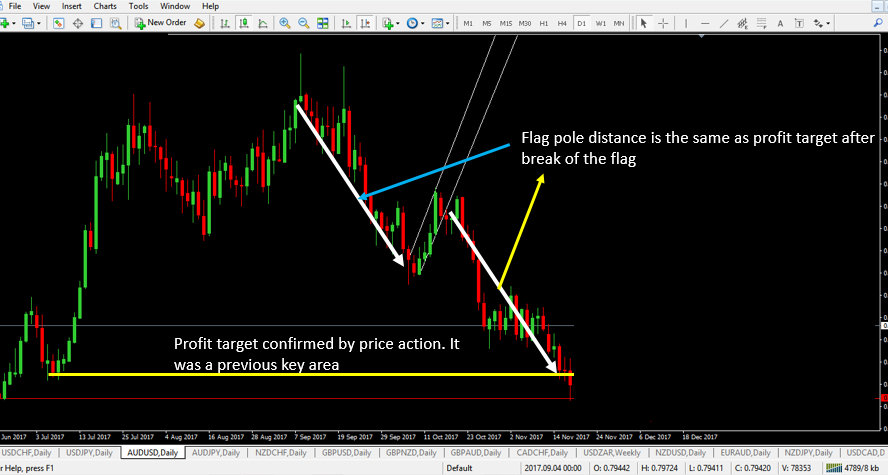

Profit targets with flags and pennants

You can use a ‘measured objective' for your profit target. The length of the flagpole can be applied to the resistance break or support break of the flag/pennant to estimate the advance or decline.

Here you can use areas of confluence to confirm your profit target.

Stop-loss placement in flags and pennants

You can set your stops on the opposite end of the pattern. If the distance to that is too big for a favourable risk-to-reward ratio you can set your stops in the middle of the pattern.

Concluding thoughts on Flags and Pennants

Even though flags & pennants are common formations, identification guidelines should not be taken lightly. It is important that flags and pennants are preceded by a sharp advance or decline. Without a sharp move, the reliability of the formation becomes questionable and trading could carry added risk.

A firm knowledge of price action and swing trading will help you uncover more profitable setups using flags and pennants in synthetic indices trading.

Other Posts You May Be Interested In

Why You Should Be Trading Price Action?

Price action represents collective human behaviour. Human behaviour in the market creates some specific [...]

What Is The Difference Between Technical Analysis Vs Fundamental Analysis?

Here are the main differences between technical analysis and fundamental analysis… Technical Analysis: technical analysis [...]

FBS Broker Review. All You Need To Know ☑️ (2024)

FBS is an online broker that offers financial market trading in forex and CFDs. This [...]

Understanding Mass Psychology In Trading

Here’s one thing about price action: it represents a collective human behavior or mass psychology. Let me explain. [...]

How To Transfer Funds From One Deriv Account To Another

It is now possible to transfer funds between two Deriv accounts belonging to two different traders [...]

Revealed: How To Become A Deriv Payment Agent

This post will teach you how to become a Deriv payment agent easily and make [...]