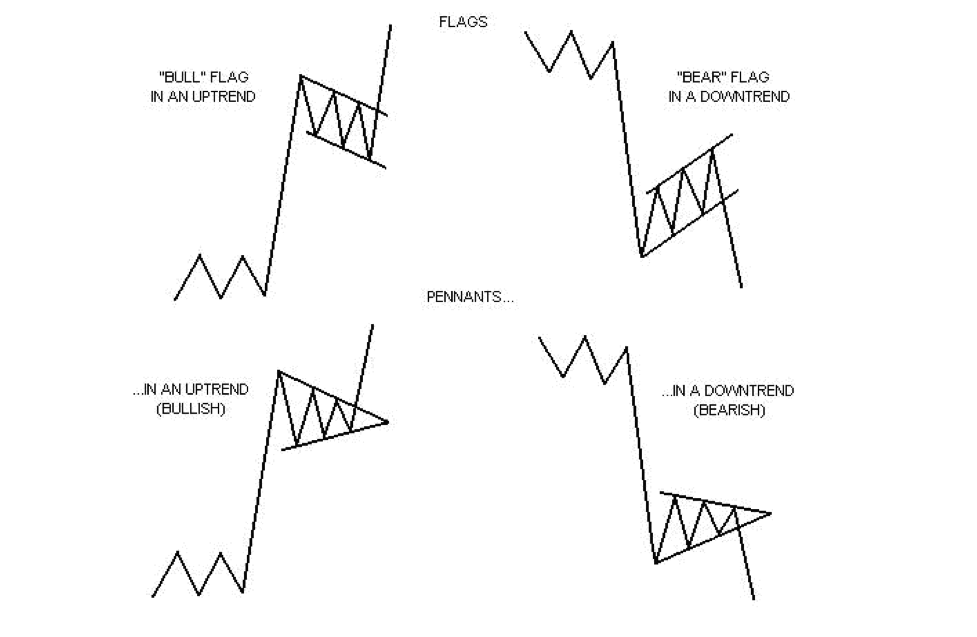

Flags and pennants are popular continuation patterns that every trader must know. Flags and pennants closely resemble each other, differing only in their shape during the pattern’s consolidation period. These patterns are usually preceded by a sharp rally or decline with heavy volume, and mark a midpoint of the move.

Flags and Pennants patterns closely resemble each other, differing only in their shape during the pattern’s consolidation period. This is the reason the terms flag and pennant are often used interchangeably.

Flags in Forex Trading

What is a flag in trading?

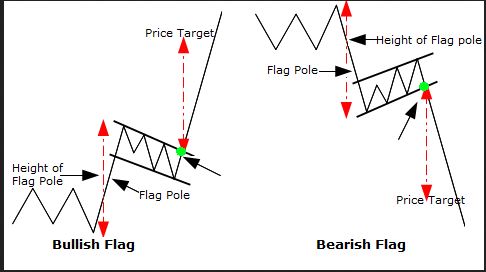

A flag is a pattern that consists of a channel of parallel trend lines that go against the previous trend. If the previous move was up, then the flag would slope down. If the move was down, then the flag would slope up.

As you can see, the flag really looks like our everyday physical flag. The pole will be the beginning of the trend, either up or down. The ‘flag cloth’ would represent the period of consolidation before the trend picks up again.

A bullish flag would just be the opposite, going up.

What is a pennant in Forex trading

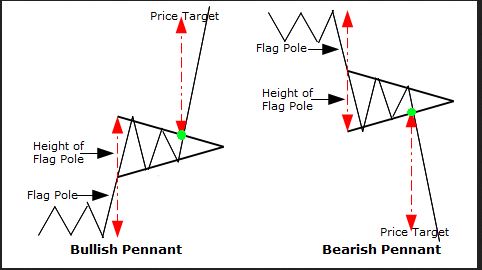

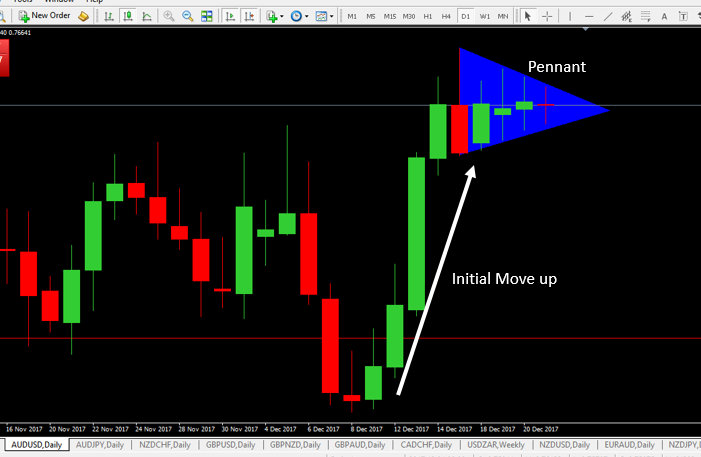

A pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone).

The symmetrical triangle shows an area where the market was consolidating before picking up again.

How to trade Flags and Pennants

You can enter at the break of the flag/pennant in the direction of the preceding trend. Sometimes the market tends to retest the broken pattern so you need to be aware of that when you set your stops.

Profit targets with flags and pennants

You can use a ‘measured objective’ for your profit target. The length of the flagpole can be applied to the resistance break or support break of the flag/pennant to estimate the advance or decline.

Here you can use areas of confluence to confirm your profit target.

Stop-loss placement in flags and pennants

You can set your stops on the opposite end of the pattern. If the distance to that is too big for a favourable risk-to-reward ratio you can set your stops in the middle of the pattern.

Concluding thoughts on Flags and Pennants

Even though flags & pennants are common formations, identification guidelines should not be taken lightly. It is important that flags and pennants are preceded by a sharp advance or decline. Without a sharp move, the reliability of the formation becomes questionable and trading could carry added risk.

A firm knowledge of price action and swing trading will help you uncover more profitable setups using flags and pennants in synthetic indices trading.

Other Posts You May Be Interested In

Brokers Offering Copy & Social Trading

Are you looking for the best list of copy trading platforms? Then look no further [...]

The Best Forex Demo Contests (Updated 2024)

Below is a list of the best and current forex demo account contests. Broker [...]

How To Trade Flags & Pennants

Flags and pennants are popular continuation patterns that every trader must know. Flags and pennants [...]

Gartley Pattern Forex Trading Strategy

This strategy is based on a pattern called the Gartley pattern. You will need the [...]

How To Trade Moving Averages With Price Action

Many new traders that find it difficult to define the structure of a trending market, [...]

Bullish Engulfing Pattern Forex Trading Strategy

One important skill as a forex trader is the ability to spot reversal patterns when [...]