One important skill as a forex trader is the ability to spot reversal patterns when they form.

One of the popular reversal patterns is the bullish engulfing pattern and the bullish engulfing pattern forex trading strategy is built around that pattern.

Engulfing patterns work well with price action trading.

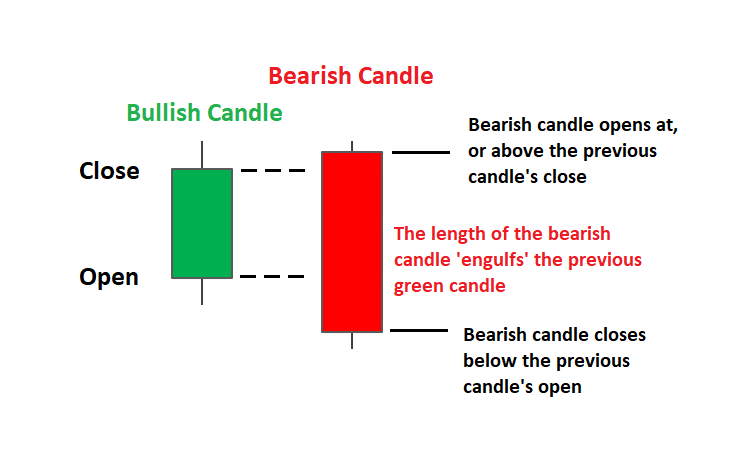

This pattern consists of 2 candlesticks, the first one is bearish and the second one is bullish.

The important thing is the fact that the second bullish candlestick “engulfs” the bearish candlestick before it.

Here is an example of a bullish engulfing pattern:

Currency Pairs: Any

Timeframes: 15minutes and above

Forex Indicators: none are required.

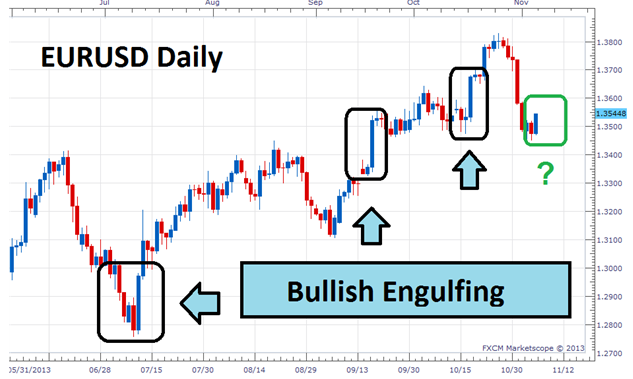

BULLISH ENGULFING PATTERNS IN ACTION

A few examples shown on the chart below, notice how the formation of bullish engulfing pattern results in price moving upward?:

The Best Location For The Bullish Engulfing Pattern

You should not take a buy trade on every single bullish engulfing pattern you see on your charts.

The location of the engulfing pattern is very critical.

You should only be looking to buy when the bullish engulfing pattern forms on these levels:

- support levels and these include resistance-turned-support levels

- on upward trendline bounces.

- on Fibonacci retracement levels

TRADING RULES For The Engulfing Pattern

- Watch the support levels, trendline bounces, and fib retracement levels.

- when you spot a bullish engulfing pattern, you can either buy at the market or place a pending buy stop order 1-2 pips above the high of the engulfing candlestick (2nd candlestick)

- Place your stop loss 2-3 pips below the low of the 2nd candlestick.

- set your take profit target levels 3 times what you risked. Say if your stop-loss is 60 pips then aim for a profit target of 180 pips.

You can trade other financial markets like synthetic indices, stocks and cryptocurrencies using the bullish engulfing strategy.

Other Posts You May Be Interested In

What Is The Difference Between Technical Analysis Vs Fundamental Analysis?

Here are the main differences between technical analysis and fundamental analysis… Technical Analysis: technical analysis [...]

Understanding Candlesticks In Trading

The candlestick chart is the most common among traders. The candlestick chart had its origins [...]

Skrill & Neteller No Longer Allowing Deposits To Deriv & Other Brokers

Popular e-wallets Skrill and Neteller have stopped processing deposits and withdrawals to and from Deriv and [...]

Gartley Pattern Forex Trading Strategy

This strategy is based on a pattern called the Gartley pattern. You will need the [...]

1. Introduction To Price Action

What Is Price Action Trading? Price action is the study of a forex pair's price [...]

HFM Broker Review (2024) ☑️ Is It Trsutworthy?

HFM Overview HFM, previously known as Hotforex was founded in 2010 and has its headquarters [...]