The Pin Bar Forex Trading Strategy is a great trading strategy for trend trading:

If you just go over your charts and just look at pin bars and just do a quick backtest, you will see how profitable this forex chart candlestick pattern can be.

The pin bar is one of the highest probability reversal candlestick patterns you can have but there’s a catch: not all pin bars are created equal. The most important thing about pin bars is where (the location) they form on the chart.

Pin bars form on all types of financial markets including cryptocurrencies, stocks and synthetic indices,

WHAT DOES A PIN BAR Candlestick LOOK LIKE?

The Pin Bar is very different from other reversal candlestick chart formations because it is a bar/candlestick with a long tail or wick, a very short body.

It looks like this:

The Pin Bar is a price action reversal pattern and when it forms, it clearly shows that the price was rejected by the market at a certain price level or point.

A Bearish Pin Bar Candlestick Formation:

- the very long tail tells you that the bulls took over and pushed the price a very long way up to form a high, but that high was not maintained.

- The bears came with such a great force and took over and pushed price down all the way, wiping away all the price gains made by the bulls. The price fell, made a low and then close a little bit below the opening price in the red.

So what does this mean? It means that when you see such a bearish pin bar formation, you should be very alert that the bears are now most likely taking over the market and will continue to push price down.

For A Bullish Pin Bar Candlestick Formation:

- a bullish pin bar formation is the exact opposite of the bearish pin bar formation: the long tail tells you that initially, the bears took control of the market and pushed the price all the way down to make a low but this low was not sustained.

- After the low was made, the bulls took over with such ferocity and force and pushed the price all the way up, completely wiping all the downward price moves made by the bears and making a high and finally closing a little bit below the high in the green.

So as a swing trader, what should you get from this? Well, it means that when you see such a candlestick formation, you should be alert now that those bulls are most likely taking over the market and will continue to push price up.

BEST LOCATIONS TO TRADE THE PIN BAR Candlestick

This is one very important criteria if you are looking to trade the pin bar: you just cannot trade all the pin bars you see.

It does not make any sense at all to trade all the pin bars you see because of one very simple reason: the location of where the pin bar forms impacts your probability of success.

So the best places to trade pin bars are these:

- Fibonacci levels of 31.8, 50 & 61.8

- Major support levels & resistance levels

- traders action zone

- trendline bounces.

- places of confluence

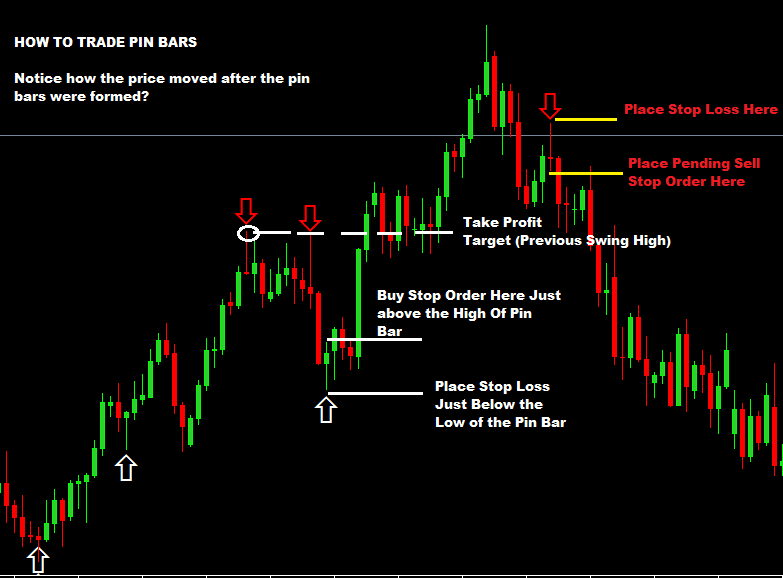

HOW TO TRADE THE PIN BAR Candlestick FORMATION

Trading the pin bar candlestick is really straightforward. Here are the rules:

- Wait and watch for the pin bar to form on the levels above like Fibonacci levels etc..listed above.

- Depending on whether it’s a bullish or bearish pin bar you will have to place a pending sell stop order 3-5 pips below the low of the bearish pin bar and place a buy stop order 3-5pips above the high of the bullish pin bar.

- Place your stop losses on the other side of the pin bars of the same distances as you placed the pending orders, that is, 3-5 pips above the high if its a sell stop order and 3-5 pips below the low if its a buy stop order.

- for take profit targets, use previous swing high points/peaks or swing low valleys/bottoms as you take profit targets.

- while the price moves favourably, you have to lock in your profits by using the trailing stop technique where you move and place behind subsequent decreasing swing high points/peaks for a sell order and behind increasing swing low points/valleys/bottoms for buy order.

- As you can see, the pin bar is a powerful setup that you can use in price action trading.

Other Posts You May Be Interested In

How To Trade Flags & Pennants

Flags and pennants are popular continuation patterns that every trader must know. Flags and pennants [...]

What is Professional Forex Trading?

A professional Forex trader is a person who uses price movement in the Forex market [...]

What Is The Difference Between Technical Analysis Vs Fundamental Analysis?

Here are the main differences between technical analysis and fundamental analysis… Technical Analysis: technical analysis [...]

Multiple Time Frame Trading

What is Multi-timeframe Analysis Multiple time frame trading is the process of analysing the same [...]

Trade The Obvious

We hope you have learnt how powerful price action trading can be. Now, not all [...]

How To Trade Moving Averages With Price Action

Many new traders that find it difficult to define the structure of a trending market, [...]