Top Forex Brokers For You

Deriv.com is a new trading platform that has roots going back 20 years to as far back as 1999. This new platform is an exciting and refreshing improvement from its predecessor Binary.com. This Deriv broker review will let you know all about the broker. We will also check if the broker is legit or if it is a scam.

According to the broker, the platform is created to be a place where people can trade what they want, how they want. This review will help you understand the history of the broker, the trading instruments offered and how you can get started with the broker.

We will also examine if Deriv is a legit broker.

This is a comprehensive guide. You can use the table of contents below to jump to your preferred section

What Is The Difference Between Deriv.com & Binary.com?

Deriv.com is a result of the rebranding of Binary.com. The broker felt that the name binary.com gave clients the idea that only binary options are offered. This would have been misleading because the broker offers so much more including forex, commodities and the popular synthetic indices.

On top of the rebranding, the broker has new features including a user-friendly interface that offers Binary.com’s platforms and other new trading instruments like multipliers. For now, Deriv.com and Binary.com will co-exist side by side but the binary.com platform will eventually be phased out. Binary.com clients can use their existing login credentials on Deriv.com.

Can You Still Trade On Binary.com?

Yes, you can but the platform will eventually be phased out so you may want to familiarise yourself with the new interface as soon as possible.

How To Open a Real Trading Account On Deriv.com Step By Step

To register a real trading account on Deriv click the button below.

Open A Free Deriv.com Account Here.You will see a box like this

Enter your email and click where it says ‘Create Demo Account‘.

Confirm your email by opening it and clicking the link. If you don’t find the email check your Junk/Spam folder. Complete the signing up by entering your preferred password and country of residence.

At this point, you would have created a Deriv demo account. You can log in and start trading with US$10 000 virtual funds. This demo Deriv account can be used to test out the broker and any strategies you might have.

2. Open A Real Trading Account On Deriv.com

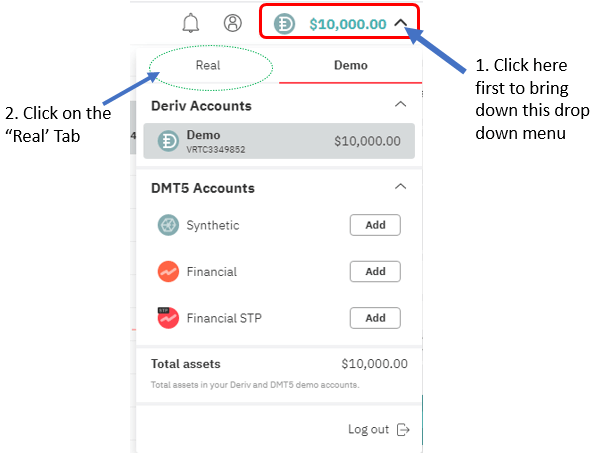

To trade real money you will need to open a ‘real’ account. To open the real account you will need to log in to the demo account you created in the step above. After logging in you will see the screen below: Begin by clicking on the dropdown menu beside the $10 000 virtual money balance.

The first option under the Real tab will be the option to add a real Deriv account. Click on the add button. The following screen will appear:

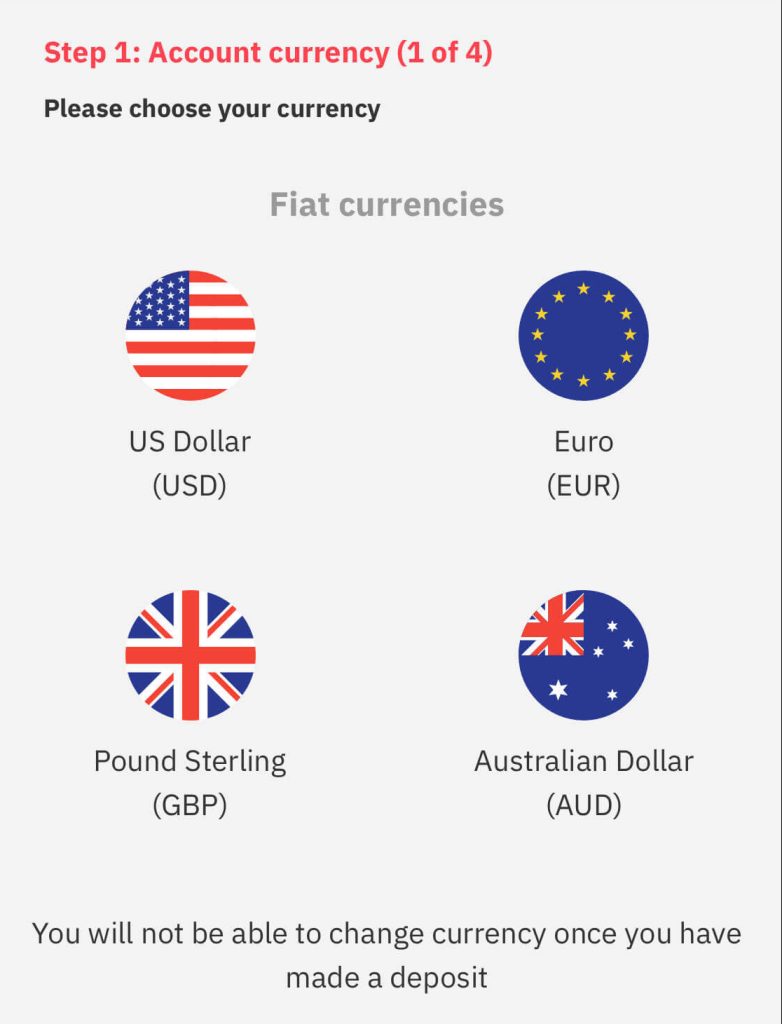

You will need to choose your preferred account currency.

This is the currency that you will use to trade, deposit and withdraw. Make sure you choose the best currency as you will not be able to change this after you have made a deposit.

You can also create another account with another currency by clicking on the button that says ‘Add or manage account’.

On the next few pages add your correct details including name, address and phone number. You will need to use details that you can later verify. This is because as part of its Know Your Customer (KYC) policy, the broker will ask you to upload your proof of residence and ID or passport.

These documents ought to have the same details you will supply during the registration. If you do not have these documents you can still trade with an unverified account. The limitation is that you will not be able to deposit and withdraw on your own. To do that you will need to make use of Deriv payment agents explained below.

The real account you would have created will allow you to trade the various assets provided by the broker. You can see the different account types and what they allow you to trade below.

Which Account Types Are Available On Deriv.com?

Deriv offers three different account types that give you access to different trading instruments.

- The Synthetic indices account allows trading on synthetic indices like boom and crash, volatility indices, and jump indices. Synthetic indices are designed to mimic the movement of real-world assets but are unaffected by real-world events such as speeches of heads of central banks, economic releases, and others. Leverage for this account goes up to 1:1000. With this account, you can trade 24/7/365 making it very convenient. This is the most popular account type on Deriv and no other broker offers synthetics. You can read this in-depth guide on how to trade synthetic indices.

- The Financial account allows CFD trading on major and minor forex pairs, commodities and cryptocurrencies, with leverage of up to 1:1000

- The Financial STP (Straight-Trough Processing) account allows Contract For Difference (CFD) trading on FX majors, minors, and exotics, with leverage up to 1:100, so it’s much lower than the other 2 accounts but it’s still very acceptable.

This Deriv broker review found that Deriv does not have an Islamic account.

Is Deriv A Regulated Broker?

Yes, Deriv is a legit forex trading broker It is a fully regulated and transparent broker with high operational standards, low trading fees, superior service delivery, and helping investors reach their objectives

Broker regulation is important because it shows that the broker adheres to strict operational guidelines that ensure that it does not scam its clients. The broker is registered in Europe to Binary Investments (Europe) Ltd., with an office in Malta.

It is also licensed and regulated as a Category 3 Investment Services provider by the Malta Financial Services Authority, with the license number IS/70156. In Asia, the broker is registered to Binary (FX) Ltd., with an office in the Federal Territory of Labuan, Malaysia.

Deriv is also licensed and regulated by the Labuan Financial Services Authority, with license number MB/18/0024. In Vanuatu, the broker is registered to Binary (V) Ltd. and is licensed and regulated by the Vanuatu Financial Services Commission, with license number 14556.

Regulation helps to determine if a broker like Deriv is legit or if it is a scam. In this case, the broker is registered in three different countries and this helps make Deriv a trusted and legit broker.

Which Assets Can You Trade On Deriv.com?

Deriv.com offers over 100 products for trading including:

- Forex – Close to 50 FX currency pairs, including majors, minors and exotics

- Stock indices – Speculate on price movements across the largest US, Asian and European stock indices

- Synthetic indices – Based on a secure random generator, synthetic indices replicate real-world market conditions and are available 24/7 delivering consistent volatility.

- Commodities

- Precious metals, such as gold and silver, plus energies like oil are available

- Cryptocurrencies

Deriv broker Review: Which Trading Platforms Are Available On Deriv.com?

This Deriv broker review found that a number of trading platforms are available on Deriv.com. These are DMT5, DTrader, Deriv X, Deriv Go & DBot.

Deriv MetaTrader 5 (DMT5)

DMT5 is Deriv’s exclusive version of the MT5 platform developed by MetaQuotes Software.

The all-in-one FX and CFD trading platform gives you access to multiple asset classes — forex, stocks, and commodities — on a single platform. All in all the platform has 100+ tradeable assets and currently has over 1 million+ clients enjoying 24/7 trading.

The broker brings the MT5 experience to a superior level for both new and experienced traders on the platform, with exclusive access to innovative trade types. DMT5 supports all the three account types offered by the broker.

You can access the DMT5 as a downloadable application on desktop and mobile (both Android & iOS). You can also access DMT5 on your browser as WebTrader although this has limited functionality.

Deriv X

Deriv X is a CFD trading platform that lets you trade various assets in multiple markets simultaneously. It’s fully customisable and packed with features that let you personalise your trading environment.

You can drag and drop the widgets you’d like to use, apply over 90 indicators and 13 drawing tools, and keep track of your progress and historical trades on one screen.

You can access Deriv X via a desktop as well as Android and iOS mobile devices.

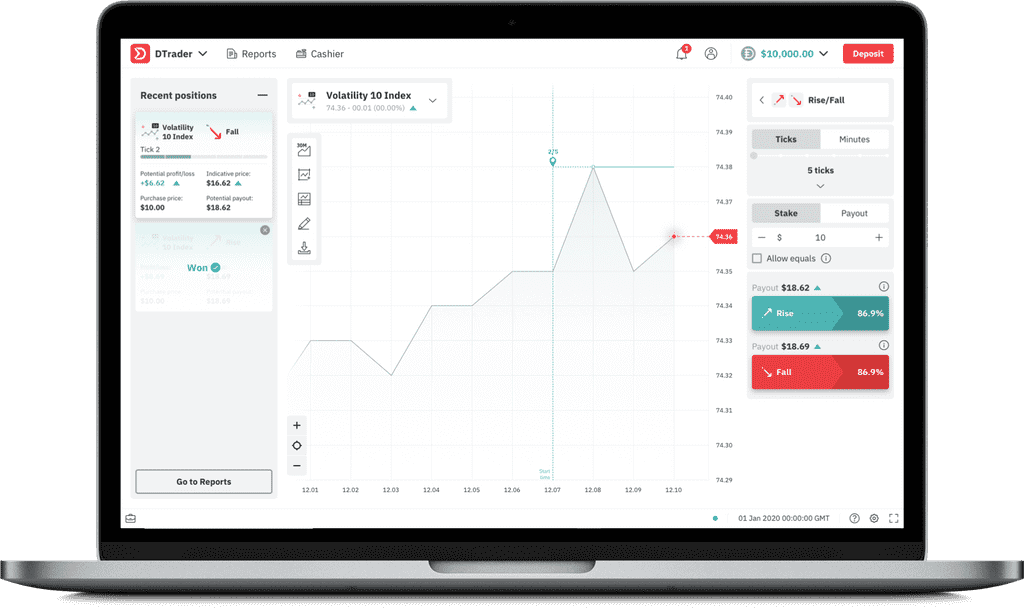

DTrader

DTrader is Deriv’s customisable web-based trading platform with a clean interface and 50+ tradable assets. You can also tailor your charts to meet your needs with technical indicators and widgets you need to make smarter trading decisions.

Trade types can also be highly customised, with a minimum position size of just $0.50 and flexible trade duration between one second and 365 days available. The potential payouts on the DTrader impressively exceed 200%. You can also trade multipliers on D Trader.

All in all, the DTrader platform is an excellent evolution in trading platforms, promising an optimal user experience.

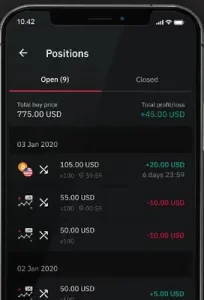

Deriv Go

Deriv GO is Deriv’s mobile app that’s optimised for on-the-go trading. With this platform, you can trade synthetic indices with multipliers where you can take advantage of risk management features such as stop loss, take profit, and deal cancellation to better manage your trade.

You can download Deriv GO from the Google play store, Apple app store, and Huawei app gallery.

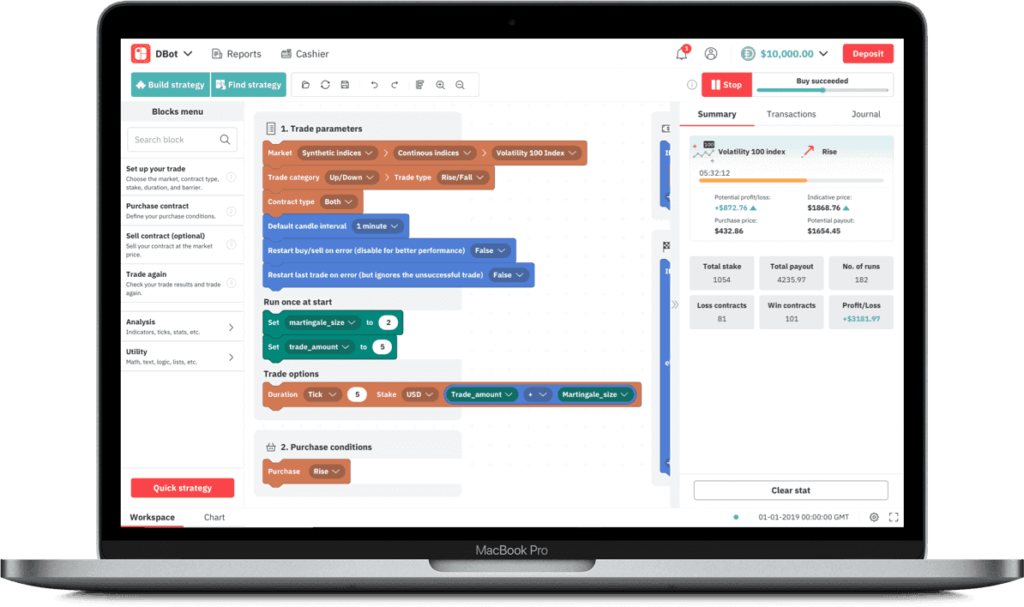

DBot

DBot is the brokers’ free robot trading platform that gives you a straightforward path to getting set up using algorithmic investing. DBot is designed to be flexible with novices and experts, and it features pre-built bots as well as options to develop custom bots

Trading bots are free to develop, can be built in five steps, and can be used on over 50 assets. There are also three pre-built strategies that traders can use as they find their feet.

A useful additional feature is the performance tracker so you can make tweaks to maximise returns. The tracker sends regular reports on Telegram.

How Do I Trade Binary Options On Deriv.com?

“Which account type do I need to trade binary options on Deriv.com?”

You do not need any special account to trade binary options on Deriv. The main ‘account’ that you set up during the registration process before setting up the different accounts above lets you trade binary options. The broker offers Binary options like Rise/Fall, Higher/Lower, Even/Odd and Touch/No touch.

How High Are The Spreads & Commissions Charged By Deriv.com?

As a trader, it is very important to know of the spreads and commissions charged by a broker since these represent the trading costs that you must endure. Deriv promises tight spreads and minimal trading fees just like its predecessor Binary.com which had a strong reputation for competitive spreads and a transparent fee structure.

In September 2021 this Deriv broker review found out that the broker further reduced spreads on forex pairs and metals making it even more competitive.

What Is the Deriv Minimum Deposit?

The Deriv minimum deposit depends on the deposit method. See the specific minimum deposits on Deriv below:

E-wallets – AirTm, PerfectMoney, Jeton Wallet, Fasapay, and WebMoney are all available, amongst others. Deposits made via e-wallets are processed instantly. The Deriv minimum deposit amount using e-wallets on Deriv is 5 of your base currency. Skrill & Neteller are no longer processing deposits and withdrawals to Deriv.

Credit/debit cards – Deriv accepts and processes instantly deposits made via both Visa and Mastercard. The Deriv minimum deposit using credit cards is10 USD/GBP/EUR/AUD.

Bank wire transfer – Deriv Minimum deposit using bank wire transfer is $10 with most deposits processed instantly.

Cryptocurrency – If you prefer cryptocurrency then you can use Bitcoin, Ethereum, Litecoin and Tether to deposit into your account. There is no minimum deposit when using cryptocurrencies, with payments processed in three blockchain confirmations.

Payment Agents – The Deriv minimum deposit you can make via payment agents is 10 of your base currency. This article explains what payment agents are and how you can apply to be one.

Deriv Peer to Peer (Dp2p)- The Deriv minimum deposit via dp2p is 1 of your base currency. This article explains how DP2P works.

The broker does not charge fees for making deposits.

What Are The Withdrawal Options on Deriv.com?

In line with making its services customer-friendly, the broker allows you to withdraw funds from your account using all of the deposit payment options.

What Is The Minimum Withdrawal Amount on Deriv.com?

- E-wallets – the minimum withdrawal on Deriv using e-wallets like AirTM is 5 of your base currency which will be processed within one working day.

- Credit/Debit Cards – minimum withdrawal on Deriv using credit cards is 10 of your base currency which will be processed within one working day.

- Cryptocurrencies – Bitcoin offers the lowest minimum withdrawal of 0.0026 while crypto withdrawal times are one working day plus three blockchain confirmations.

- Payment Agents – The minimum withdrawal you can make via payment agents is $10 of your base currency.

- Deriv Peer to Peer (Dp2p)– The minimum withdrawal you can make via DP2P is $1 of your base currency.

As with deposits, the broker’s customers aren’t charged any fees to withdraw profits.

Where is Deriv Broker Located?

Deriv (SVG) LLC is located in Hinds Buildings, Kingstown, St. Vincent and the Grenadines (company no. 273 LLC 2020). This Deriv broker review found that the broker also has offices in Dubai (UAE), Malta, Cyprus, Malaysia (3), France, Channel Islands, Paraguay, Rwanda and Belarus.

How Can I Contact Deriv.com Customer Support?

This Deriv broker review found that customer support is available 24/7 on Deriv through the Help Centre. This is a self-service portal that can assist with a range of queries, from account questions to platform issues. It’s a knowledge base of some sort.

Live Chat – Live chat support is now available direct from the website but you will be talking to a bot. If your issue is not resolved you will then be transferred to a human

Email Support – The broker can also be contacted via their email at [email protected]

Deriv Broker Review: The Advantages Of Trading On Deriv

- Offers a wide variety of deposit and withdrawal methods

This makes it very convenient for traders. Using other options like Dp2p and payment agents further makes it easy for traders to move money into and out of their accounts using local payment methods that are not directly accepted by the broker.

- Offers the popular synthetic indices

Deriv is the only broker that offers synthetics that have become so popular with traders due to uniform volatility and their 24/7 availability

- Offers binary, forex, crypto & synthetic trading

There is a wide range of instruments that you can trade using the broker. This increases convenience.

- Multiple verifications

The broker has multiple regulations

- Offers lucrative partner program

The broker offers a partnership program that allows you to earn a lifetime commission from the trades of your referred clients for life. This. is a great way way to earn passive income on top of your trading income. Application to be an affiliate partner is free and you can do it here. This article explains what the Deriv affiliate program is and how you can increase your earnings.

Deriv Broker Review: The Disadvantages Of Trading On Deriv

- Does not offer copy or social trading

Copy trading allows amateur traders to copy the trades of professionals and profit from their expertise. This feature is not offered by the broker

- Offers high leverage of up to 1:100

Leverage can be a double-edged sword. It can help amplify your profits but it can also massively increase your losses if you are not careful

- Some of the assets on Deriv do not have respect stop losses or they have wide stop-loss levels.

Stop-loss levels are a critical aspect of risk management. However, some assets offered by the broker like the boom and crash indices do not respect the stop-loss levels during spikes and this can significantly drain your account. Assets like v100 also have wide stop loss levels that expose a significant chunk of your equity to the market.

- Does not accept US & UK-Based clients

US-based traders cannot open accounts with this broker due to restrictions

- No Bonus

Deriv does not give any kind of no-deposit or deposit bonus to its clients.

FAQ’s on Deriv Broker Review

Is Deriv a trusted broker?

This Deriv broker review is satisfied Deriv.com is a trustworthy broker that’s regulated in multiple jurisdictions. The services offered by Deriv.com are provided by the Deriv Group. The group has several companies that are licensed to operate Deriv.com in their jurisdictions.

What is Deriv?

Deriv is a forex, synthetic indices, cryptocurrency and commodities broker that was established in 2020 as a result of the rebranding of binary.com

Is Deriv regulated?

Yes, Deriv broker is regulated in a number of jurisdictions.

Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Other Posts You May Be Interested In

Heikin Ashi Forex Trading Strategy

Heikin-Ashi candles are a variation of Japanese candlesticks and are very useful when used as [...]

HFM Broker Review (2024) ☑️ Is It Trsutworthy?

HFM Overview HFM, previously known as Hotforex was founded in 2010 and has its headquarters [...]

Why You Should Be Trading Price Action?

Price action represents collective human behaviour. Human behaviour in the market creates some specific [...]

How To Trade Fibonacci With Price Action

Fibonacci retracement levels were discovered by an Italian mathematician by the name of Leonardo Fibonacci [...]

How To Trade Confluence With Price Action

Confluence refers to a junction of two or more items. For example, the place where [...]

Trade The Obvious

We hope you have learnt how powerful price action trading can be. Now, not all [...]