What Is Day Trading? This is the definition of day trading in the context of forex trading: buying and selling of currency pairs over a one-day period with the objective of profiting from the price moves that are made within that day. Day trading is also known as ‘Intraday trading’ where day traders are usually […]

Author Archives: Jafari Omar

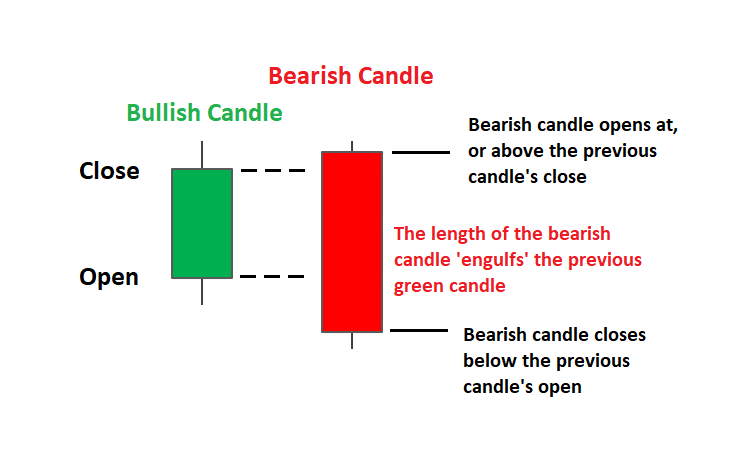

One important skill as a forex trader is the ability to spot reversal patterns when they form. One of the popular reversal patterns is the bullish engulfing pattern and the bullish engulfing pattern forex trading strategy is built around that pattern. Engulfing patterns work well with price action trading. This pattern consists of 2 candlesticks, the first one is bearish […]

The Pin Bar Forex Trading Strategy is a great trading strategy for trend trading: If you just go over your charts and just look at pin bars and just do a quick backtest, you will see how profitable this forex chart candlestick pattern can be. The pin bar is one of the highest probability reversal […]

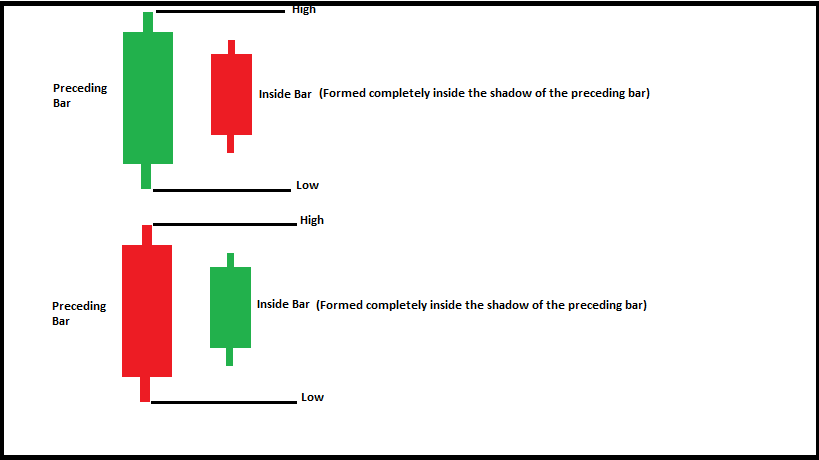

The inside bar forex trading strategy can be classified as a simple price action trading strategy that even new traders, as well as veteran forex traders, can use. If you are a housewife forex trader or somebody who does not spend a lot of time in front of your trading charts because of work, this […]

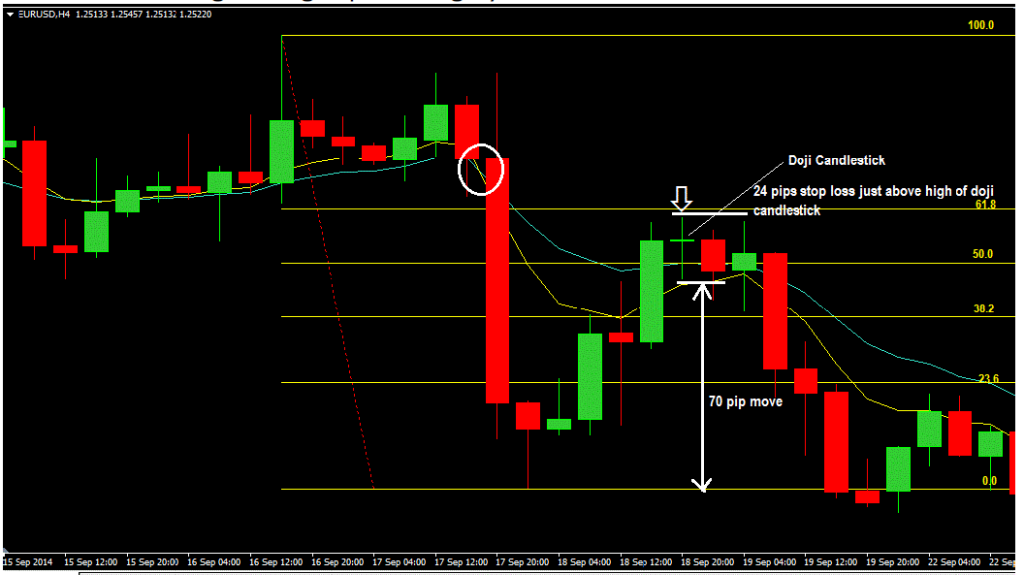

We hope you have learnt how powerful price action trading can be. Now, not all trading setups you see will become winners. But here’s the thing…if your losses are small but your profits are large, you will always be in be out in front. That’s why trading risk management is important. When you are watching […]

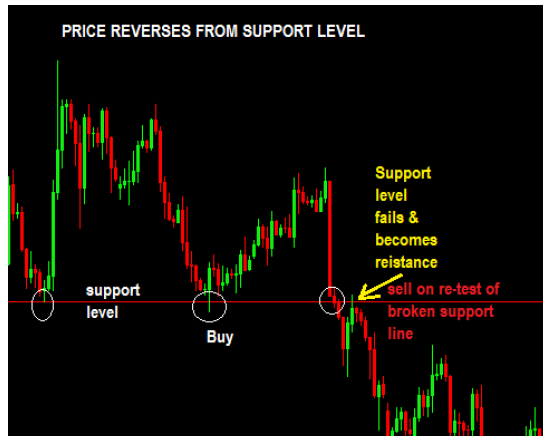

A reversal is a term used to describe when a trend changes (reverses) direction. This is a critical part of price action trading. Now, where can reversals and continuation patterns happen? Support levels Resistance levels Fibonacci levels Here’s an example of price reversing from a support level that went up and then later broke […]

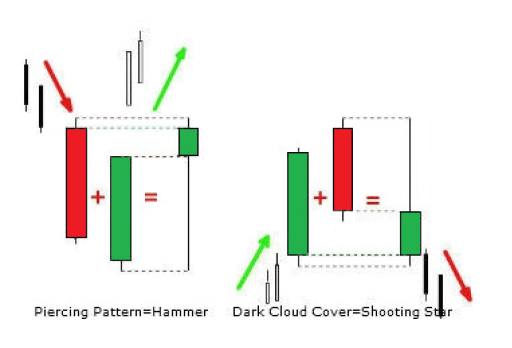

The candlestick chart is the most common among traders. The candlestick chart had its origins in Japan and can also be referred to as the Japanese candlestick chart. The colour of the candlestick chart tells you if the price was up or down in a particular timeframe which means that candlesticks are either bullish or […]

Here’s one thing about price action: it represents a collective human behavior or mass psychology. Let me explain. All human beings have evolved to respond to certain situations in certain ways. And you can see this happen in the trading world as well: The way multitude of traders think and react form patterns… repetitive price patterns that one can […]

Price action represents collective human behaviour. Human behaviour in the market creates some specific patterns on the charts. So price action trading is really about understanding the psychology of the market using those patterns. That’s why you see price hits support levels and bounces back up. That’s why you see price hits resistance levels and […]

What Is Price Action Trading? Price action is the study of a forex pair’s price movement. To really understand price action means you need to study what happened in the past. You must then observe what is happening in the present and then predict where the market will go next. All price movement in Forex […]