Top Forex Brokers For You

Synthetic Indices have been traded for over 10 years with a proven track record for reliability are they are still rising in popularity amongst traders the world over. However, there are still some misconceptions around them and in this post, we will explain what these synthetic indices are and why you should be trading them.

This comprehensive guide will show you all you need to know about synthetic indices.

You can use the table of contents below to jump to your preferred section.

What are Synthetic Indices?

Synthetic indices are a type of unique trading instruments that are simulated to reflect or mimic (copy) the behaviour of real-world financial markets.

In other words, synthetic indices behave like real-world markets in terms of volatility and liquidity risks but their movement is not caused by an underlying asset.

Stock markets, for example, move in response to the price movement of the stock. The same happens in forex markets where the forex chart moves up and down in response to the price of the forex pair.

A key feature of these synthetic indices is that they are not affected by fundamentals like world events or news.

Synthetic indices are available to trade 24/7, have constant volatility and fixed generation intervals. Volatility here refers to the degree of variation of price over time.

A Synthetic Index attempts to simulate the behaviour of an entire type of market, just like the way a Stock Index (like The Dow Jones or S&P 500) has a more generalised focus than an individual Stock.

What moves synthetic indices?

Synthetic indices move through the use of random numbers which are generated by a cryptographically secure computer programme (algorithm).

The algorithm generates value for the synthetic indices guided by the type of market conditions they are designed to simulate.

For example, the algorithm will give random numbers to reflect a booming market for the Boom indices. The random numbers generated will show a spike in the price of the index time and again, just as how a booming market will perform in the real world.

Which Broker Offers Synthetic Indices?

At the moment, there is only one synthetic indices broker that provides these trading instruments on different trading platforms. That broker is Deriv.com (formerly known as Binary.com). Deriv is a pioneer and market leader in trading with over 20 years of experience and multiple awards.

The broker also has more than three million satisfied customers. You can open your synthetic indices account on Deriv below.

Why Is There Only One Synthetic Indices Broker (Deriv)

Deriv is the only broker that offers synthetic indices trading in the world because it ‘created and owns‘ the algorithm that runs these indices.

No other broker can offer these trading instruments because they do not have access to the random number generator and if they did, it would be illegal. This is why there are no other synthetic indices brokers.

On the contrary, over 1000 brokers offer forex and stock trading instruments because no one ‘owns’ these markets. Any broker that can get real-time quotes of the forex and stock markets can easily provide them for trading to their clients.

Are Synthetic Indices Manipulated?

No synthetic indices from Deriv are not manipulated. Otherwise, it would be illegal as it would be grossly unfair to its clients. Synthetic indices move through random numbers generated by an algorithm. For transparency issues, the broker is unable to influence or predict which numbers will be generated.

This is just like in real-world financial markets where the broker has no influence on the price movements.

The random number generator is also regularly audited for fairness by an independent third party to ensure fairness. This ensures that the broker is not disadvantaging traders by manipulating the volatility/synthetic indices.

Binary.com, which has now rebranded to Deriv.com, has been in existence for over 20 years and is a fully regulated broker.

In the EU, Deriv is regulated by the Malta Financial Services Authority (FSA). For traders outside of the EU, the broker is licensed by the Vanuatu Financial Services Commission (FSC) and the British Virgin Islands Financial Services Commission (FSA).

In addition, Deriv is regulated by Malaysia’s Labuan Financial Services Authority (FSA). Now all these regulatory authorities would not let this broker get away with manipulating synthetic & volatility indices to their advantage.

They would promptly suspend the broker from operating in their jurisdictions. The fact that this has not happened is testimony to the fact that the broker does not manipulate volatility indices.

You can read the full Deriv broker review for more information.

Open A Synthetic Indices Account

How To Trade Synthetic Indices On MT5

Deriv is the only synthetic indices broker on mt5. Thus, you need a dedicated account inside your main Deriv account to be able to trade synthetic indices on MT5.

This is because Deriv offers a variety of different trading instruments including forex currencies, cryptocurrencies, stocks, commodities and, of course, synthetic indices.

You will need different accounts when you create your main Deriv account to trade these different instruments.

In this section, we are going to look specifically at how you can open a synthetic indices account and then how to trade synthetic indices on MT5 in six easy steps.

How To Open a Deriv Synthetic Indices Trading Account On Deriv.com Step By Step

-

Open A Deriv.com Account

First, you need to create Deriv real account by clicking the button below. They will take you to the Deriv real account sign up page.

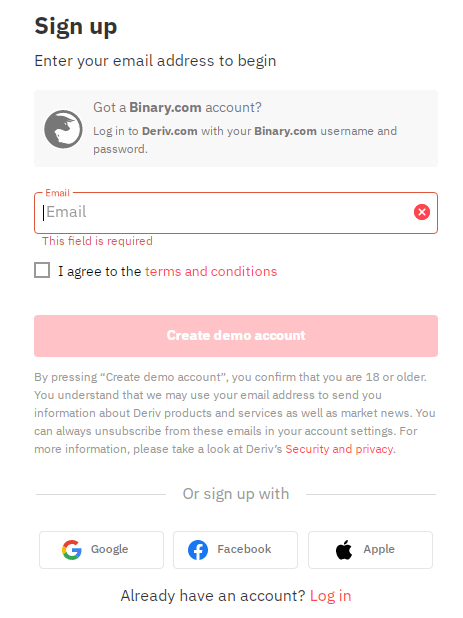

Open Deriv Account HereThis is the same account used for trading binary options on Deriv so do not worry if you see written material on binary trading. You will see a box like this:

Enter your email and click where it says ‘Create Demo Account‘. Confirm your email by opening it and clicking the link sent by Deriv.

If you don’t find the email check your Junk/Spam folder. The email looks like the one below.

You can also do Deriv signup for a synthetic indices account using Facebook, Gmail and your Apple Id by clicking on any of the buttons below the signup page. After completing this step you will have created a Deriv demo account.

2. Open Deriv Real Account

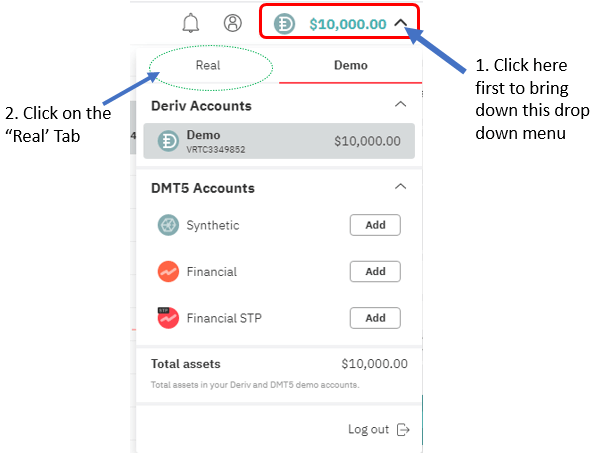

By default, you will first create Deriv demo account with virtual funds of $10 000 when you do Deriv sign up. This Deriv demo account is meant to help you get used to the platform and try out strategies etc.

To trade real money you will need to continue with Deriv.com sign up and open a ‘Real Deriv account’. To do the Deriv real account registration you will need to do Deriv.com login into the Deriv demo account you created in the step above.

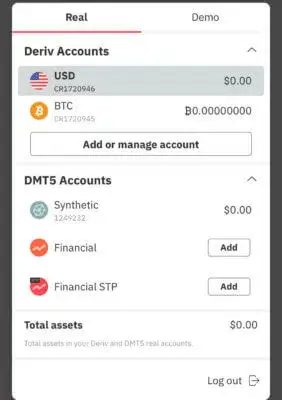

After logging in you will see the screen below.

Begin by clicking on the drop-down menu beside the $10 000 virtual money balance. This will allow you to open Deriv real account.

The first option under the Real tab will be the option to create a real Deriv account. Click on the ‘Add’ button.

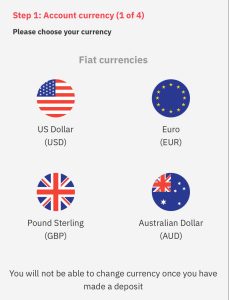

The following screen will appear as the next step in Deriv real account sign up.

You will need to choose your preferred account currency. This is the currency that you will use to trade, deposit and withdraw. Make sure you choose the best currency as you will not be able to change this after you have made a deposit.

- You can also create another account with another currency by clicking on the button that says ‘Add or manage account’.

- On the next few pages add your correct details including name, address and phone number. You will need to use details that you can later verify. This is because as part of its Know Your Customer (KYC) policy, Deriv will ask you to upload your proof of residence and ID or passport.

These documents must have the same details you will supply during the Deriv real account registration. This article explains how you can easily verify your Deriv account after you create Deriv real account.

3. Open Deriv Real Account MT5 Synthetic Indices Trading Account

The Deriv real account you created on the Deriv.com sign up step above will allow you to trade real money on binary options on Deriv. However, you will need to do Deriv real account registration on mt5 to trade synthetic indices. In other words, you will have to open Deriv real account on mt5.

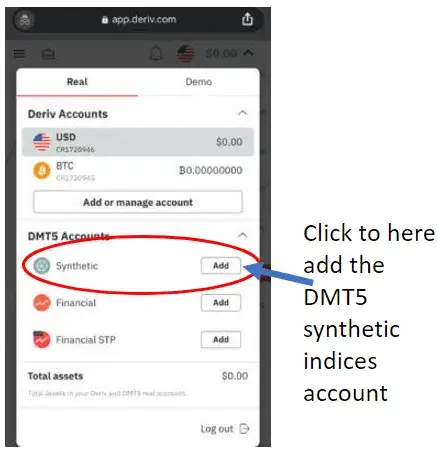

Click on the ‘Real’ tab and you will see the option to add up to three DMT5 accounts i.e Deriv synthetic indices account, a financial account for trading forex, and financial STP account.

Click on the Add button next to the synthetic account and then set the password. This is the password you will use for the Deriv synthetic indices account only. It’s not the main account password.

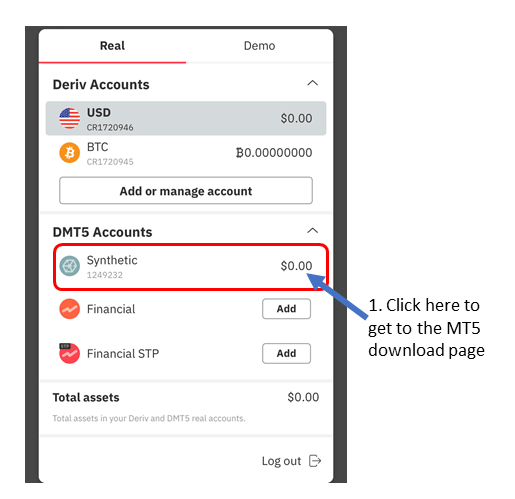

After creating the Deriv synthetic indices account on mt5 you will now see it listed in your dashboard. It will have a couple of numbers below and this will be your login ID which you will use together with the password to log in. You will also get an email with your login ID and password.

You will need to transfer funds from the main Deriv account to your Deriv synthetic indices account mt5 so that you can trade. At this point, you will have completed Deriv real account registration mt5.

After creating the Deriv real account mt5 you will now see the account listed with your login ID. You will also get an email with your login ID that you will use to log in to the mt5 synthetic indices account.

After creating your account you will be prompted to transfer funds from your main Deriv account to your DMT5. If you want to practice you can create Deriv demo account mt5 here.

4. Download the Deriv mt5 (DMT5) platform

You will need to download the Deriv mt5 platform.to activate your Deriv real account mt5. This is the next step as you create Deriv real account.

To do this you must click on the Deriv synthetic indices account as shown below.

You will then be taken to a page with links to the Deriv Mt5 application. You can:

- download the Deriv app for PC (Deriv mt5 desktop app download)

- download Deriv mt5 for Android

- download the Deriv mt5 app for iOS.

You can also choose to trade on the Deriv web terminal if you want.

5. Log in to your Deriv MT 5 Synthetic Indices account

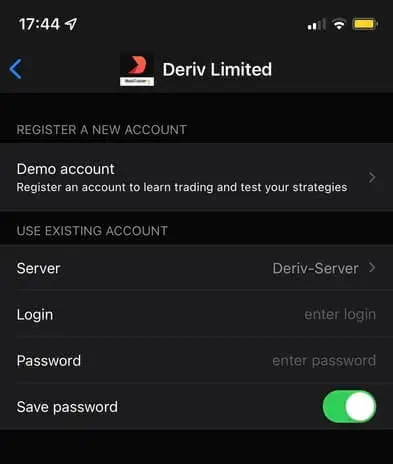

After downloading and installing your DMT5 you will then need to log in to your trading account to finish creating your Deriv real account.

Click on Settings> Log in to new account.

You will need to enter the following details:

You will need to enter the following:

Broker: Deriv Limited

Server: Deriv-Server

Login: put the Login ID that you got when you opened the Deriv real synthetic indices trading account. You can also see it when you click on the ‘Real‘ tab in your Deriv account. It will be a string of numbers starting with “CR”

Password: Use the password you chose when you created the real synthetic indices account.

Make sure you type these correctly because if you make mistakes you will not be able to connect to your trading account. Also, remember to put in the credentials for your Deriv synthetic indices account and not for the main real Deriv account.

At this point, you would have completed Deriv com sign up successfully.

How to Trade Synthetic Indices pdf

You can download this free pdf that shows you how to trade synthetic indices profitably below.

List of Synthetic Indices offered by Deriv.com

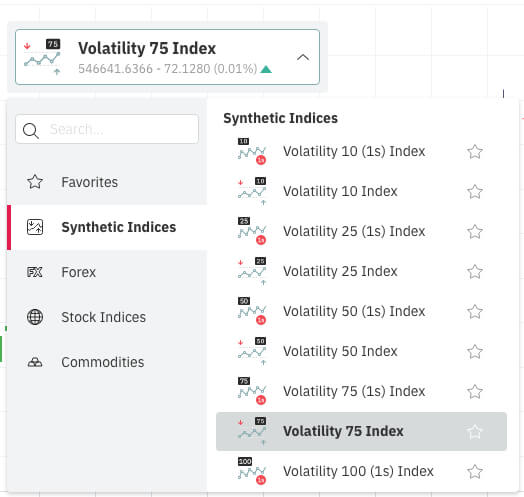

After finalising your Deriv real account mt5, you will find out that there are five types of Synthetic Indices available on the Deriv mt5 trading platform.

Below is a list of synthetic indices:

- Volatility Indices

- Crash & Boom Indices

- Jump Indices

- The Step Index and

- Range Break Indices.

1. What Are Volatility Indices On Deriv.com

Volatility Indices on Deriv.com are a type of synthetic indices which are engineered to reflect real-world markets with constant volatility.

Financial market volatility refers to changes in asset prices over time. A very volatile market will have big changes in the asset price in a short time. A market with low volatility will have small price movements even after a relatively long time.

The reflected monetary market volatility on Deriv is measured on a scale from 1 to 300. 1 represents a market with minimum volatility while 300 represents a market with three times the maximum possible volatility.

These indices correspond to simulated markets with constant volatilities of 10%, 25%, 50%, 75%, 100%, 200%, and 300%.Deriv is the only volatility indices broker.

Deriv.com offers various volatility indices namely;

- Volatility 10 Index (V10 Index)

- Volatility 25 Index (V25 Index)

- Volatility 50 Index (V50 Index)

- Volatility 75 Index (V75 Index) This is the most popular volatility index

- Volatility 100 Index (V100 Index)

What do the numbers on Deriv’s Volatility Indices mean?

These numbers indicate the volatility of the index relative to real-world market volatility.

Market volatility is measured on a scale from 1 to 300 with 300 being three times the maximum market volatility. Thus, the Volatility 300 (1s) Index represents 300% market volatility and the Volatility 10 Index has only 10% of the real-world market volatility.

In other words, the Volatility 10 Index has just 10% of the volatility of the V100 Index. Volatility 50 has 50% of the volatility of the V100 Index and so on.

These indices update at the rate of one tick every two seconds. A tick is the minimum price movement of an index.

1 Second Volatility Indices (1s)

There is another group of indices that update faster with a tick every second and they are called the 1(s) indices. These indices are just like the above-mentioned indices and you can see them listed below;

- Volatility 10 Index (1s)

- Volatility 25 Index (1s)

- Volatility 50 Index (1s)

- Volatility 75 Index (1s)

- Volatility 100 Index (1s)

- Volatility 200 (1s) (V200 1s)

- Volatility 300 (1s) Index

So which one is the most volatile synthetic index?

The Volatility 100 index (V100 index) has the highest volatility of all the indices that update at the rate of one tick every two seconds.

On the other hand, the Volatility 300 (1s) index has the most volatility of all the indices that update at the rate of one tick per second.

The volatility 10 index (v10) has the least volatility. It has only 10% of the volatility of v100 index.

On the (1s) volatility indices V10 (1s) is the least volatile index with the slowest price changes over time

The high volatility seen on these indices allows traders to make a lot of profit in a short time from relatively small balances.

See an example below where a trader was able to make over $70 profit from a deposit of just $3 trading Volatility 75. The trader was using 0.001 which is the smallest lot size on Volatility 75.

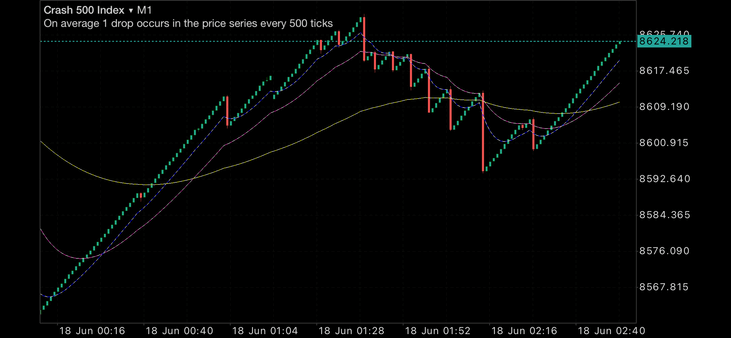

2.) Crash & Boom Indices On Deriv

The crash and boom indices are engineered to reflect rising and falling real-world monetary markets. In other words, they behave specifically like a booming or crashing financial market.

They are different from volatility indices or currencies which have a more ‘normal’ behaviour.

There are four types of boom and crash indices namely:

- Boom 300 Index

- Boom 500 Index

- Boom 1000 Index

- Crash 300 Index

- Crash 500 Index

- Crash 1000 Index

The Boom 500 index has on average 1 spike in the price series every 500 ticks while the Boom 1000 index has on average 1 spike in the price series every 1000 ticks.

Similarly, the Crash 500 Index has on average 1 drop in the price series every 500 ticks, while the Crash 1000 Index has on average one drop in the price series every 1000 ticks. The Boom and Crash 300 indices have one crash or spike on average once every 300 ticks in the price series.

Just like other synthetic indices, there is only one Boom 1000 index broker and that broker is Deriv. There are no other brokers that offer boom and crash indices

Boom & Crash Indices Minimum Lot Sizes

Lot sizes determine the trade size you can place. Below are the minimum boom & crash indices minimum lot sizes.

| Boom 1000 Index | 0.2 |

| Crash1000 Index | 0.2 |

| Boom 500 Index | 0.2 |

| Crash 500 Index | 0.2 |

Boom & Crash Indices Minimum Deposit & Margin Requirements

You can deposit as little as $1 to your synthetic indices account. However, you will not be able to trade boom and crash with such a low account balance.

The margin requirements and the minimum lot sizes needed to trade boom and crash will not allow you to place trades with such a low balance.

Below are the margin requirements and the minimum account deposit needed to trade the different boom and crash indices.

| BOOM & CRASH INDEX | MARGIN REQUIREMENTS FOR 0.2 LOT SIZE | MINIMUM ADVISABLE ACCOUNT BALANCE REQUIRED |

|---|---|---|

| Boom 1000 Index | $6.01 | $20 |

| Boom 500 Index | $2.51 | $10 |

| Crash 1000 index | $3.53 | $12 |

| Crash 500 Index | $3.72 | $13 |

3.) The Step Index.

The Step Index simulates a market step by step. It has an equal probability of going up or down with a fixed step of 0.1 The step index has a minimum lot size of 0.1.

4.) Range Break Indices

The range break indices simulate a ranging market that breaks out of a range after several attempts on average.

There are two types of Range Break indices: Range 100 index and Range 200 index.

The Range 100 index breaks out after an average of 100 attempts while the Range 200 index breaks out after 200 attempts on average.

6.) Jump Indices

The Jump indices measure jumps of an index with assigned Volatility. There are 4 jump indices namely;

- Jump 10 Index,

- Jump 25 Index,

- Jump 50 Index

- and Jump 100 index

The jump 10 index has an average of three jumps per hour with uniform volatility of 10%.

The Jump 100 index has an average of 3 jumps per hour with uniform volatility of 100%.

Lot Sizes in Synthetic Indices

Lot sizes determine the smallest trade amount you can place. This is a list of the smallest lost sizes for each different synthetic index.

What are the minimum lot sizes in trading synthetic indices?

Volatility Index |

Smallest/ Minimum lot size |

| Volatility 10 Index | 0.3 |

| Volatility 25 Index | 0.50 |

| Volatility 50 Index | 3 |

| Volatility 75 Index | 0.001 |

| Volatility 100 Index | 0.2 |

| Volatility 10 (1s) Index | 0.5 |

| Volatility 25 (1s) Index | 0.50 |

| Volatility 50 (1s) & Volatility 75 (1s) Index | 0.005 |

| Volatility 100 (1s) Index & Step Index | 0.1 |

| Volatility 200 (1s) | 0.2 |

| Volatility 300 (1s) | 1 |

| Boom & Crash 1000 Index | 0.2 |

| Crash 500 Index & Boom 500 Index | 0.2 |

| Boom & Crash 300 Index | 0.1 |

How do you calculate synthetic indices lot sizes?

Calculating pips and lot sizes in synthetic indices trading can be a bit tricky. This is because each synthetic index has its own different lot size as opposed to forex where all pairs use the same lot size with the minimum being 0.01.

How to calculate minimum synthetic indices stop-loss & take profit levels

Frequently Asked Questions on Synthetic Indices

What is the best time to trade synthetic indices?

Can you trade synthetic indices on MT4?

How many synthetic indices brokers are there?

Does Deriv have mt4?

Are synthetic indices legit?

Yes, they are legit trading instruments as they are offered by a regulated broker

Conclusive Remarks on How To Trade Synthetic Indices

Synthetic indices offer a different trading experience that can be profitable. Their increasing popularity the world over is a testament of this.

We would suggest you take your time and practice these markets on a demo account before risking your money.

Volatility Indices from Deriv.com have a maximum leverage of 1:1000 and this can be a double-edged sword. It can prop up and amplify your profits as well as your losses.

Click the button below to get started.

Open Deriv.com Account HereSo give us your feedback. Are you interested in trading synthetic indices from Deriv.com? Do you need further help? Leave your thoughts in the comment box below and we will definitely get back to you.If you found this post helpful you can share it with your friends so that they can benefit too.

This post is also available in the following languagesDisclaimer

The products offered on the deriv.com website include binary options, contracts for difference (“CFDs”) and other complex derivatives. Trading binary options may not be suitable for everyone. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, the products offered on the website may not be suitable for all investors because of the risk of losing all of your invested capital. You should never invest money that you cannot afford to lose and never trade with borrowed money. Before trading in the complex products offered, please be sure to understand the risks involved.

Other Posts You May Be Interested In

Brokers Offering Copy & Social Trading

Are you looking for the best list of copy trading platforms? Then look no further [...]

1. Introduction To Price Action

What Is Price Action Trading? Price action is the study of a forex pair’s price [...]

Understanding Mass Psychology In Trading

Here’s one thing about price action: it represents a collective human behavior or mass psychology. Let me explain. [...]

Comprehensive Guide To Trading With Stop-Loss Orders

Stop-loss orders and take-profit orders are a very critical part of trading. In fact, they [...]

What Is An Islamic Forex Account?

What Is An Islamic Forex Account? An Islamic, or ḥalāl forex trading account is a [...]

The Best Brokers Offering Forex No Deposit Bonus In 2024

Forex brokers offer a unique opportunity for new traders to start trading without risking their [...]