This post will teach you how to become a Deriv payment agent easily and make money via commissions.

Deriv introduced payment agents in 2020 as a way of helping traders withdraw and deposit easily using local payment methods. Since then, these payment agents have become very popular and have moved more than US$ 10 million.

What Is A Deriv Payment Agent?

A Deriv payment agent is an independent exchanger authorised to process deposits and withdrawals for Deriv’s clients in their respective countries. In other words, they make it possible to move funds from one Deriv account to another.

How Do Payment Agents Work In Deriv?

Deriv payment agents work by allowing clients to deposit and withdraw using methods that are not supported on the Deriv website.

For example, a forex trader in Kenya may want to fund their account using mobile money like Mpesa but they can’t do that directly on the Deriv website. They can contact a local Deriv payment agent and then arrange to have the payment agent fund their account while they pay them using Mpesa.

In a withdrawal scenario, the trader may wish to withdraw but their withdrawal method is not supported by Deriv. It may also be that their preferred withdrawal method does not provide services to their country.

What happened when Skrill closed accounts for some countries including Zimbabwe & Zambia comes to mind.

The trader will then withdraw funds via an agent and that agent can pay the trader either using cash, bank transfers or mobile money as per the arrangement. In both instances, if payment agents did not exist then the trader would have been stuck and would not have had the opportunity to either deposit or withdraw.

Who Can Become A Payment Agent On Deriv?

Anyone over 18 with a verified Deriv account can apply to become a Deriv payment agent. There are no costs involved in applying to be a Deriv agent.

Requirements Needed To Become A Deriv Payment Agent

The Following Is Required To register as a Deriv payment agent:

- A fully verified Deriv trading account (If you don’t have a Deriv account you can apply for one here & learn how to verify the account here)

- At least US$2000 account balance in Deriv at the time of application

- Your name, email address, and contact number

- Preferred Deriv Payment Agent name. This is the name that will be displayed on the payment agent list for your country

- Your website and social media pages/channels (Facebook/Instagram/Telegram/

WhatsApp) where you promote your payment agent services - A list of accepted payment methods (these are the payment methods that are not accepted on Deriv that you will use to get paid by traders e.g local bank transfer, mobile money & cash)

- The commissions you will charge on deposits and withdrawals. These are subject to Deriv’s established thresholds of 1-9% and you cannot go above them.

- You may also be asked to state the methods you will use to fund your payment agent account so that you have the balance needed to deposit to the client’s accounts (e.g PerfectMoney or AirTm)

- You can also apply for a Deriv partner account. The Deriv partner account will allow you to earn even more lifetime passive commission from your referred traders and it will also expand your client base. Application for the account is free and you can apply here. This is different from your usual trading account.

How To Register As A Payment Agent On Deriv

- Send an email with the above requirements to [email protected].

- Deriv will review your application and get in touch for further information and the next steps.

- After final approval from Deriv’s compliance team, they will publish your details on their payment agent list.

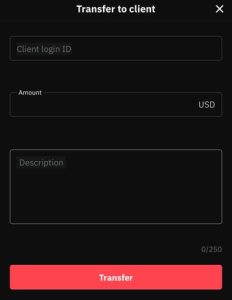

- You will then see the ‘Transfer To Client‘ option in your Deriv cashier and you can then start processing deposits and withdrawals on behalf of clients

How To Deposit To A Clients’ Account As A Payment Agent

1. Log into your Deriv account & click on Deriv Cashier>Transfer To Client (you will only see this option after you have been approved as an agent) You will see a page like this

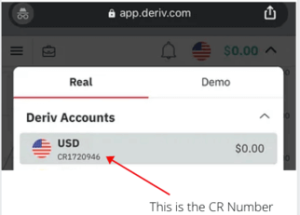

2. Enter the Clients login ID (CR Number). The client gets this number after registering for a real account on Deriv.

3. Enter the amount and any description needed. Click Transfer.

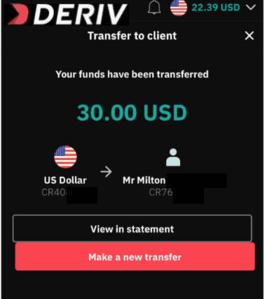

4. You will see a confirmation page with the clients’ name, Cr number and amount. Verify these details and complete the transfer. the Deriv withdrawal via payment agents is instant.

You will see a confirmation page like the one below after a successful transfer.

How To Process Withdrawals As A Deriv Payment Agent

1. The client gets in touch with you and confirms your agent name and cr number. The minimum they can withdraw through you is US$10

2. They log into their account and click on Deriv Cashier>Payment agents

3. They click on ‘request withdrawal form’ and confirm via email

4. They put in your Deriv Payment agent details

5. They confirm the transactions and the funds are moved from their account to your account instantly

6. You pay them using the pre-agreed method

How Do You Make Money As A Payment Agent On Deriv?

The commission that you charge for processing deposits and withdrawals is the money that you make when you become a Deriv payment agent.

If your commission rate for both deposits and withdrawals is 7% you will make that much on every transaction you process.

Thus, if a client wants to deposit US$100 they will have to send you $107. If they want to withdraw they will send you $100 and you will sen them US$93.

The more transactions you process, the more profit you make. You will need to aggressively market your Deriv payment agent services to attract more clients. Offering fast and reliable services will help you be regarded as the best payment agent on Deriv in your country and thus get you more business.

Another great way to increase your earnings from Deriv will be to register as an affiliate partner. Here you will also get to make up to 45% commission from each and every trade that your referred clients will make on Deriv for life. This will be passive income that you can earn while you sleep!

How Do You See The Payment Agent List For Your Country?

- log in to your Deriv real account

- Click on Cashier

- Click on Payment agents

- You will see a list of payment agents that you can use to deposit or withdraw with

Advantages Of Becoming A Payment Agent On Deriv

You:

- set the commission rate that you want for processing deposits & withdrawals

- can perform multiple deposits and withdrawals per day.

- choose the countries you want to serve

- can easily convert your trading profits to local currency at any time by funding other traders accounts

- can make transfers 24/7

- can earn even more lifetime commission by signing up as a Deriv affiliate partner

- increase your business exposure eg if you offer a signal service you can then get more clients

- can still use your account to trade normally

- can process deposits and withdrawals for clients who have not verified their trading accounts

- choose the payment methods you want to accept

- Application to become a Deriv payment agent is free and you can close your account at anytime

Conclusion On Payment Agents on Deriv

Deriv agents have made it very easy for traders to deposit and withdraw in countries with poor and unreliable banking systems.

If you become a Deriv payment agent you will greatly help your local traders and also get to make some money in the process.

Have you used a payment agent before? Would you like to become a Deriv payment agent?

Share your thoughts in the comments below.

Other Posts You May Be Interested In

Understanding Mass Psychology In Trading

Here’s one thing about price action: it represents a collective human behavior or mass psychology. Let me explain. [...]

Skrill & Neteller No Longer Allowing Deposits To Deriv & Other Brokers

Popular e-wallets Skrill and Neteller have stopped processing deposits and withdrawals to and from Deriv and [...]

How To Trade Synthetic Indices: A Comprehensive Guide For 2024

Synthetic Indices have been traded for over 10 years with a proven track record for [...]

How To Make Money Without Trading As Deriv Affiliate Partner

Do you know you can earn up to 45% lifetime commission on Deriv without placing any [...]

Understanding Candlesticks In Trading

The candlestick chart is the most common among traders. The candlestick chart had its origins [...]

The Best Brokers Offering Forex No Deposit Bonus In 2024

Forex brokers offer a unique opportunity for new traders to start trading without risking their [...]