In , a micro lot equals 1/100th of a or 1,000 units of the .A micro lot usually is the smallest size that you can trade with. If one micro lot of the is being traded, each pip would be worth $0.1, as opposed to $10 for a standard lot. The following are the quantities typically used in the :

- A standard lot = 100,000 units of base currency

- A = 10,000 units of base currency

- A micro lot = 1,000 units of base currency

- A nano lot = 100 units of base currency

Margin

The required collateral that an investor must deposit to hold a position.

Margin call

A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer

Market maker

A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product.

Market order

An order to buy or sell at the current price.

Market risk

Exposure to changes in market prices.

Offer (also known as the Ask price)

The price at which the market is prepared to sell a product. Prices are quoted two-way as Bid/Offer. The Offer price is also known as the Ask. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the ask price is 1.4532, meaning you can buy one US dollar for 1.4532 Swiss francs.

One cancels the other order (OCO)

A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled.

Open order

An order that will be executed when a market moves to its designated price. Normally associated with Good ’til Cancelled Orders.

Open position

An active trade with corresponding unrealized P&L, which has not been offset by an equal and opposite deal.

Order

An instruction to execute a trade.

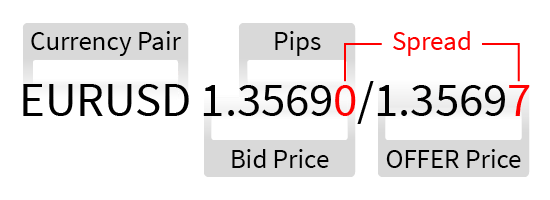

Pips

The smallest unit of price for any foreign currency, pips refer to digits added to or subtracted from the fourth decimal place, i.e. 0.0001.

Pullback

The tendency of a trending market to retrace a portion of the gains before continuing in the same direction.

Quote

An indicative market price, normally used for information purposes only.

Rally

A recovery in price after a period of decline.

Range

When a price is trading between a defined high and low, moving within these two boundaries without breaking out from them.

Realized profit / loss

The amount of money you have made or lost when a position has been closed.

Resistance level

A price that might act as a ceiling. The opposite of support.

Retail investor

An individual investor who trades with money from personal wealth, rather than on behalf of an institution.

Risk

Exposure to uncertain change, most often used with a negative connotation of adverse change.

Risk management

The employment of financial analysis and trading techniques to reduce and/or control exposure to various types of risk.

Running profit / loss

An indicator of the status of your open positions; that is, unrealized money that you would gain or lose should you close all your open positions at that point in time.

Sell

Taking a short position in expectation that the market is going to go down.

Short position

An investment position that benefits from a decline in market price. When the base currency in the pair is sold, the position is said to be short.

Sidelines, sit on hands

Traders staying out of the markets due to directionless, choppy, unclear market conditions are said to be ‘on the sidelines’ or ‘sitting on their hands’.

Simple Moving Average (SMA)

A simple average of a pre-defined number of price bars. For example, a 50 period daily chart SMA is the average closing price of the previous 50 daily closing bars. Any time interval can be applied.

Slippage

The difference between the price that was requested and the price obtained typically due to changing market conditions.

Spread

The difference between the bid and offer prices. The difference between ASK and BID is called spread. It represents brokerage service costs and replaces transactions fees. Spread is traditionally denoted in pips. You should be aware of the spread before you place a trade. Higher spreads mean higher transaction costs and vice versa. Some brokers have high spreads and we recommend these brokers with small spreads: Hotforex, Instaforex, Ava Trade, XM and Octa Forex.

Stop loss hunting

When a market seems to be reaching for a certain level that is believed to be heavy with stops. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered.

Stop order

A stop order is an order to buy or sell once a pre-defined price is reached. When the price is reached, the stop order becomes a market order and is executed at the best available price. It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at the stop level if the market does not trade at this price. A stop order will be filled at the next available price once the stop level has been reached. Placing contingent orders may not necessarily limit your losses.

Stop entry order

This is an order placed to buy above the current price, or to sell below the current price. These orders are useful if you believe the market is heading in one direction and you have a target entry price.

Stop loss order

This is an order placed to sell below the current price (to close a long position), or to buy above the current price (to close a short position). Stop loss orders are an important risk management tool. By setting stop loss orders against open positions you can limit your potential downside should the market move against you. Remember that stop orders do not guarantee your execution price – a stop order is triggered once the stop level is reached, and will be executed at the next available price.

Support

A price that acts as a floor for past or future price movements.

Support levels

A technique used in technical analysis that indicates a specific price ceiling and floor at which a given exchange rate will automatically correct itself. Opposite of resistance.

T/P

Stands for “take profit.” Refers to limit orders that look to sell above the level that was bought, or buy back below the level that was sold.

Technical analysis

The process by which charts of past price patterns are studied for clues as to the direction of future price movements.

Trade size

The number of units of product in a contract or lot.

Unrealized gain/loss

The theoretical gain or loss on open positions valued at current market rates, as determined by the broker in its sole discretion. Unrealized Gains/Losses become Profits/Losses when the position is closed.

Volatility

Referring to active markets that often present trade opportunities.