Wannan dabarar ta dogara ne akan tsarin da ake kira tsarin Gartley.

Kuna buƙatar Alamar alamar Gartley mt4 wanda zaku iya zazzagewa kuma ku loda akan taswirar mt4 ɗinku.

Menene Tsarin Gartley?

- Tsarin Gartley tsari ne wanda ya dogara da shi Fibonacci lambobi ko rabo.

- tsarin shine retracement kuma tsarin ci gaba wanda ke faruwa a lokacin da yanayin ya juyo na ɗan lokaci kafin a ci gaba da tafiya ta asali.

- tsarin yana ba da saitunan shigarwa mai ƙarancin haɗari lokacin da tsarin ya cika kuma farashin ya fara juyawa.

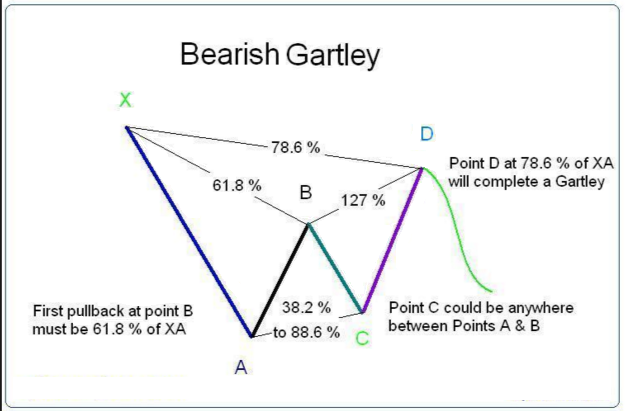

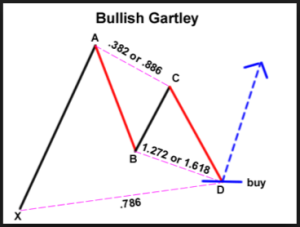

Menene Tsarin Gartley Bullish yayi kama?

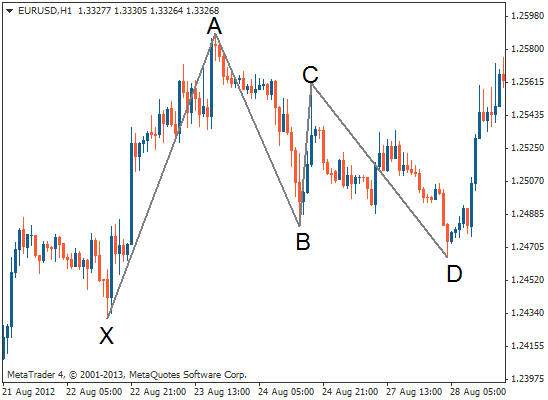

Wannan ginshiƙi na ƙasa shine kyakkyawan yanayin don ƙirar Gartley Bullish.

Idan ka duba da kyau… yana kama da sifar “M”, ko ba haka ba?

Da kyau, idan kuna iya tunanin ƙirar Gartley mai ban tsoro a matsayin ginshiƙi ginshiƙi wanda yayi kama da harafin M amma tare da ɗan ƙaramin kafaɗa a gefen dama. Wannan zai sa ya fi sauƙi a gare ku don ganin wannan tsari a kan jadawalin ku.

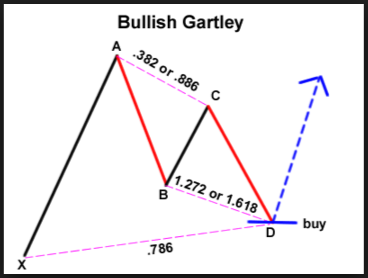

Bari mu rushe shi mataki-mataki don ku fahimci abin da kowanne bangare da lambobi akan tsarin Gartley na bullish ke nufi:

Duba waɗannan ƙananan layukan masu dige masu ruwan hoda, a can? Waɗancan suna nuna matakan sake dawo da Fibonacci. Misali, zaku iya ganin cewa akan layin XD hoda mai digo, akwai lamba da aka rubuta wacce ita ce 0.786. Wannan kawai yana nufin cewa D batu shine 78.6 % Fibonacci matakin sake dawo da farashi daga XA.

Da zarar kun fahimci wannan, yana ba ku sauƙin fahimtar wasu.

Misali, maki C na iya zama matakin retracement na 38.2% ko 88.6% Fibonacci na nisan farashin da aka yi tafiya daga BC.

Yanzu, bari mu shiga cikin cikakkun bayanai na kowace ƙafa (Kafa a nan tana nufin farashin maki da aka motsa, misali, lokacin da farashin ya tashi daga aya X zuwa A, to ana kiran wannan ƙafar XA).

XA:

- Wannan ita ce kafa mafi tsayi na tsarin lokacin da farashin ya tashi daga aya X zuwa A

AB:

- wannan shine lokacin da farashin ya canza hanya kuma ya sauko daga batu A zuwa B.

- Wannan motsi na AB yana sa 61.8% Fibonacci Retracement na ƙafar XA.

- Ƙafar AB ba dole ba ne ta wuce maki X, idan ta yi haka, ba ta da inganci.

BC:

- lura cewa farashin ya canza hanya kuma yana motsawa sama amma bai wuce maki A ba.

- Wannan motsi ya kamata ya kasance ko'ina daga 32.8% zuwa 88.6% Fibonacci retracement na kafa AB.

CD:

- wannan shine ƙafar ƙarshe na ƙirar Gartley na bullish kuma shine ainihin mahimmanci saboda wannan shine inda zaku saya lokacin da tsarin ya cika.

aya D shine 78.6% Fibonacci matakin retracement na ƙafar XA.

ko maki D kuma na iya zama 127% ko 161.8% Fibonacci tsawo na ƙafar BC.

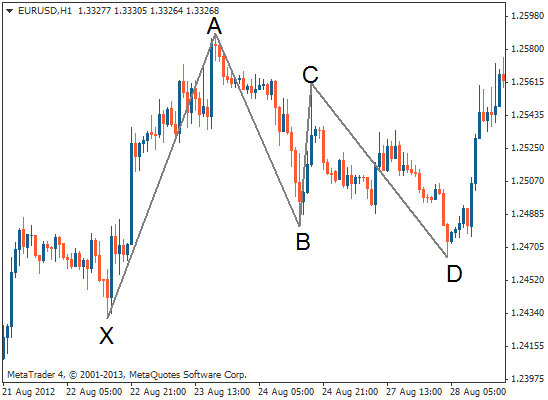

A kan ainihin ginshiƙi, tsarin kasuwancin Gartley mai ban sha'awa yayi kama da haka:

Wannan ginshiƙi da ke ƙasa yana nuna alamar kasuwancin Gartley iri ɗaya a sama amma wannan lokacin tare da kari na Fibonacci da retracements da aka zana:

Yadda Ake Ciniki Tsarin Gartley (Tsarin Gartley Trading Strategy)

Kuna neman siye ko siyarwa a batu D na tsarin.

Ka tuna, aya D = 78% Fibonacci retracement na ƙafar XA amma duk waɗannan "ƙafafun" dole ne su fara farawa kafin alamar C.

Sayi Saita Bulish Gartley Pattern

- Point D

- Nemo tsarin jujjuyawar alkukin kyandir.

- Sanya a saya dakatar da jiran oda aƙalla pips 2 sama da tsayin wannan fitila mai juyowa

- Place dakatar da hasara 2-5 pips da ke ƙasa da ƙananan waccan fitilar jujjuyawar wutar lantarki idan an kunna odar ku na jiran aiki ko kuma idan asarar tasha ta yi kusa, matsa gaba kaɗan kuma nemo mafi kusa da jujjuya ƙasa kuma sanya shi kaɗan kaɗan a ƙasan sa don haka kuna da ƙasa. damar tsayawa waje da wuri.

- Don cin riba, kuna da zaɓuɓɓuka biyu, yi amfani da ma'ana C ko A, waɗannan maki biyun sune ainihin abubuwan da suka gabata.

Rashin Amfanin Tsarin Gartley Pattern Forex Trading System

- yana iya zama da wahala ra'ayi don fahimtar yawancin 'yan kasuwa na forex saboda tsarin Gartley yana da dintsi na abubuwan da dole ne a kafa don sanya shi ingantaccen tsarin Gartley.

- Yawancin bincike mai zurfi na fasaha yana da hannu ta amfani da kayan aikin Fibonacci kuma wani lokacin yana iya zama "zato" don gano wanda shine "XA" ko "AB" kafa da dai sauransu.

Amfanin Tsarin Gartley Pattern Forex Trading System

- idan saitin tsarin kasuwanci na Gartley ya tabbatar daidai kuma cinikin yana tafiya kamar yadda aka tsara, haɗarin: sakamakon wannan tsarin ciniki yana da girma sosai.

- Matsayin shiga kasuwancin ku akan ma'ana "D" wuri ne mai kyau don ɗaukar shigarwar kasuwanci saboda idan bincikenku yayi daidai kuma farashin ya juya daga can kamar yadda ake tsammani, yana motsawa ƙasa ko sama da sauri yana ba ku pips masu fa'ida da sauri. kuma wannan na iya ba ka damar motsa asarar tasha zuwa karye don yin ciniki cikin haɗarin ciniki kyauta.

- ciniki ne na farashi da gaske kuma abin da zaku iya yi shine ƙarin koyo game da tsarin jujjuyawar kyandir ɗin forex don taimaka muku gano mafi kyawun sigina ko siyar da siginar "D".

Kawar da Gartley Gartley

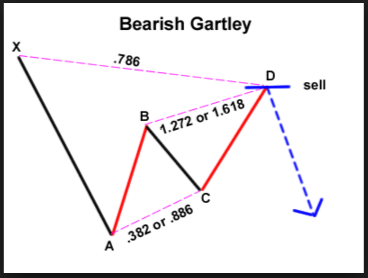

Wannan kishiyar tsarin kasuwancin Gartley ne na sama.

XA:

- Wannan ita ce kafa mafi tsayi na ƙirar lokacin da farashin ke motsawa ƙasa daga aya X zuwa A

AB:

- wannan shine lokacin da farashin ya canza hanya kuma yana motsawa daga aya A zuwa B.

- Juya baya na farko a maki B dole ne ya zama kashi 61.8% na kafar XA.

- Ƙafar AB ba dole ba ne ta wuce maki X, idan ta yi haka, ba ta da inganci.

BC:

- Point C na iya zama 38.2% zuwa 88.6% Fibonacci retracement na kafar AB.

CD:

- aya D shine 78.6% Fibonacci matakin retracment na kafar XA.

- D kuma na iya zama 127% ko 161.8% fibonacci tsawo na ƙafar BC.

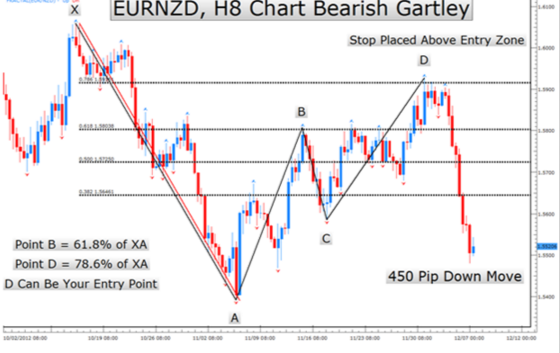

Ga wani ginshiƙi na gartley bearish tare da ƙarin bayani kuma:

Ga yadda tsarin Gartley na bearish zai yi kama da jadawalin ku:

Ga wani misali na Bearish Gartley:

Yadda Ake Ciniki The Bearish Gartley

Kuna neman siyar a batu D na tsarin.

Ka tuna, aya D=78% Fibonacci retracement na ƙafar XA amma duk waɗannan "ƙafafun" dole ne su fara farawa kafin alamar C. Yi amfani da manufar riba kamar yadda aka bayyana a sama.

Tsarin yana aiki don kowane nau'in kasuwannin kuɗi ciki har da hannun jari, forex da kuma fihirisar roba.

Wasu Rubuce-rubucen da Kuna iya Sha'awar

Skrill & Neteller Ba Ya Bada Bada Bada Adadi Zuwa Tsari & Sauran Dillalai

Shahararrun e-wallets Skrill da Neteller sun daina sarrafa adibas da cirewa zuwa kuma daga Deriv da [...]

Menene Islamic Forex Account?

Menene Asusun Forex na Musulunci? Asusun kasuwanci na Islama, ko halal na kasuwanci shine [...]

Yadda Ake Ciniki Haɗuwa Tare da Ayyukan Farashi

Haɗin kai yana nufin mahaɗar abubuwa biyu ko fiye. Misali, wurin da [...]

Binciken Dillalin FBS. Duk abin da kuke buƙatar sani ☑️ (2024)

FBS dillali ne na kan layi wanda ke ba da kasuwancin kasuwancin kuɗi a cikin forex da CFDs. Wannan [...]

Fahimtar Mass Psychology A Kasuwanci

Ga abu ɗaya game da aikin farashi: yana wakiltar ɗabi'ar ɗan adam gamayya ko ilimin halin ɗabi'a. Bari in yi bayani. [...]

Ciniki A bayyane

Muna fatan kun koyi yadda ƙarfin aikin cinikin farashi zai iya zama. Yanzu, ba duka [...]