Bincika The Chapters

8. Samfuran Chart Mai Riba Kowane ɗan kasuwa Ya Bukatar Sanin

9. Yadda Ake Ciniki Fibonacci Tare da Ayyukan Farashi

10. Yadda Ake Ciniki Trendlines Tare da Ayyukan Farashi

11. Yadda Ake Ciniki Matsakaici Tare da Ayyukan Farashi

12. Yadda Ake Ciniki Haɗuwa Tare da Ayyukan Farashi

13. Ciniki Tsararren Lokaci da yawa

15. Kariya & Kammalawa Tare da Kasuwancin Ayyukan Farashi

Wani masanin lissafi dan kasar Italiya mai suna Leonardo Fibonacci ya gano matakan dawo da fibonacci a karni na goma sha uku. Leonardo Fibonacci yana da "Aha!" lokacin da ya gano cewa za a iya amfani da jerin lambobi masu sauƙi waɗanda suka ƙirƙiri ma'auni don kwatanta daidaitattun abubuwan da ke cikin sararin samaniya.

Yawancin yan kasuwa ba su gane cewa matakan Fibonacci sun kasance a kusa da nisa fiye da kasuwar Forex kanta.

A haƙiƙa, jerin lambobi da Mista Fibonacci ya gano an yi amfani da su a cikin komai daga nazarin sararin samaniya zuwa ma’anar karkatar da karkatattun dabi’u, kamar waɗanda ake samu a cikin bawoyin katantanwa da kuma irin nau’in iri a cikin tsire-tsire na furanni.

Ee, kun karanta wannan dama - katantanwa bawo da tsire-tsire masu furanni.

To menene wannan jerin lambobi da ya gano?

Gidauniyar Fibonacci Retracement Matakan

Ba kamar yawancin kayan aikin ciniki na Forex a can ba, sirrin da ke bayan matakan retracement na Fibonacci yana da sauƙin fahimta. Wannan saboda matakan kawai asalin jerin lambobi ne.

Jerin Lambobin Fibonacci kamar haka:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, da dai sauransu.

Idan ka lura, kowace lamba a cikin jeri ita ce jimillar lambobi biyu da suka gabata. Don haka idan muka rushe wannan zai zama kamar haka…

0 + 1 = 1

1 + 1 = 2

2 + 1 = 3

3 + 2 = 5

5 + 3 = 8

da dai sauransu.

Wannan tsari yana ci gaba da ƙarewa. A wannan lokaci, kuna iya tambayar dalilin da yasa wannan ya zama na musamman. To, don masu farawa kowace lamba a jere tana kusan sau 1.618 fiye da lambar da ta gabata. Don haka ko da yake lambobin sun bambanta, duk suna da wannan sifa ta gama gari.

Yanzu, ban sani ba game da ku amma abu daya da na ci gaba da gani shi ne cewa farashin mataki yana mutunta matakan Fibonacci… ba koyaushe ba amma lokacin da ya aikata, wasu motsin kasuwa da aka haifar na iya sa ku kuɗi cikin sauƙi. Dabarar ita ce amfani da Fibonacci kuma haɗa shi tare da aikin farashi ta amfani da juzu'i na fitilu.

Amma da farko, idan baku taɓa jin labarin kayan aikin retracement na Fibonacci ba, to ga taƙaitaccen gabatarwa…

Menene Kayan Aikin Retracement Fibonacci?

Wannan kayan aiki jerin ko jerin lambobi ne da wani mutum mai suna Leonardo Fibonacci ya gano a cikin 13thKarni.

Don haka menene ainihin Fibonacci Retracement?

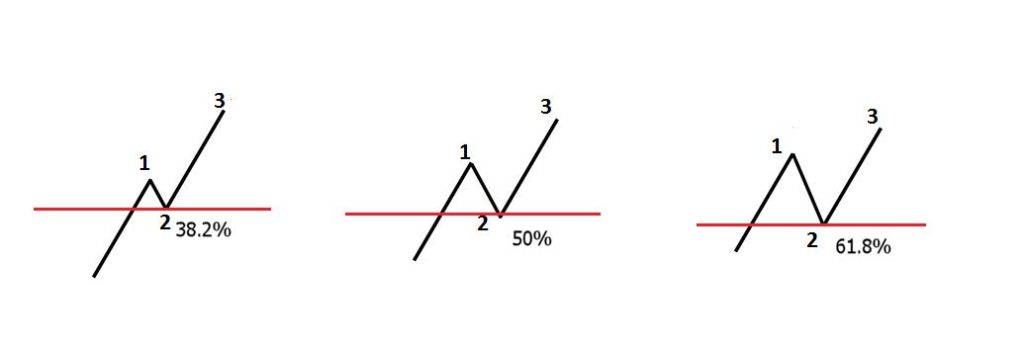

In fasaha analysis, Fibonacci retracement aka halitta ta shan biyu matsananci maki (yawanci babban ganiya da trough) a kan forex ginshiƙi da kuma rarraba a tsaye nisa da key Fibonacci rabo na 23.6%, 38.2%, 50%, 61.8% da 100%. Da zarar an gano waɗannan matakan, ana zana layi a kwance kuma ana amfani da su don gano yiwuwar goyan baya da matakan juriya.

Matakan fib guda biyu da na fi amfani da su sune 50% da 61.8%. A gaskiya ba na mayar da hankali ko kadan a kan sauran.

Idan kana amfani da Platform Trading, kayan aikin Fibonacci yana da gunki kamar yadda aka nuna a cikin ginshiƙi da ke ƙasa:

Me yasa kuke Buƙatar Kayan aikin Retracement na Fibonacci:

- A cikin raguwa, bayan farashin ya ragu na ɗan lokaci, zai koma baya (upswing… tuna?). Kayan aikin dawo da Fibonacci na iya taimaka muku ƙididdigewa ko hasashen yuwuwar juyar da farashin wurare ko matakan.

- Hakazalika, a cikin haɓakawa, farashin zai sa ƙananan ƙananan motsi (downswings) da kuma kayan aiki na Fibonacci zai taimake ka ka tsinkayi yankunan da za su iya juyawa ko matakan farashin.

- Idan aka yi amfani da su tare da matakan tallafi da juriya kuma haɗe tare da aikin farashi, da gaske suna samar da haɗin gwiwa mai ƙarfi kuma suna ba da siginar ciniki mai fa'ida sosai. Wannan yana bayyana wani abu da aka sani da "hadarin farashi". Zan kara magana akan hakan anjima.

Yadda ake Amfani da Kayan aikin Fibonacci akan Metatrader4

Haƙiƙa tsari ne mai sauƙaƙan mataki 3:

Mataki na 1: nemo kololuwa (matakin juriya/matakin juriya) da tudun ruwa (matakin saukarwa/matakin tallafi)

Mataki 2: Danna gunkin kayan aikin Fibonacci akan ginshiƙi.

Don matakai na gaba, duk dannawa da ja tsari ne…

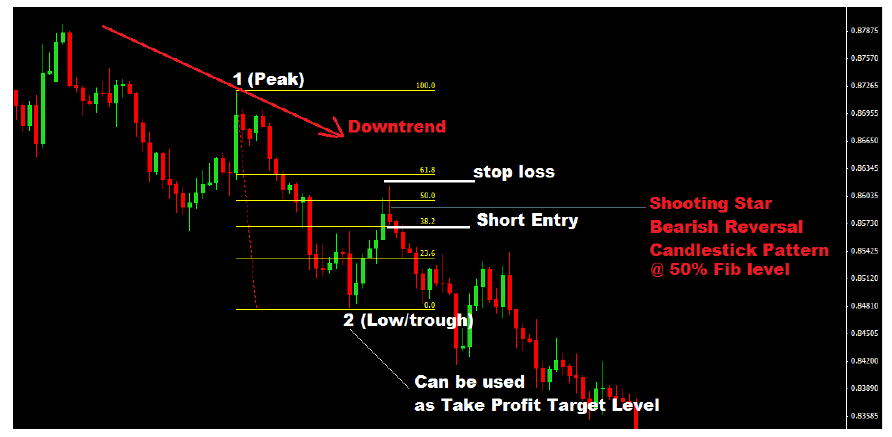

Mataki na 3a: A cikin kasuwar da ke ƙasa, za ku fara danna farko a kan kololuwar da ta gabata inda kuke son yin nazari daga kuma ja ƙasa zuwa tudun ruwa inda farashin ya koma baya kuma aka sake shi.

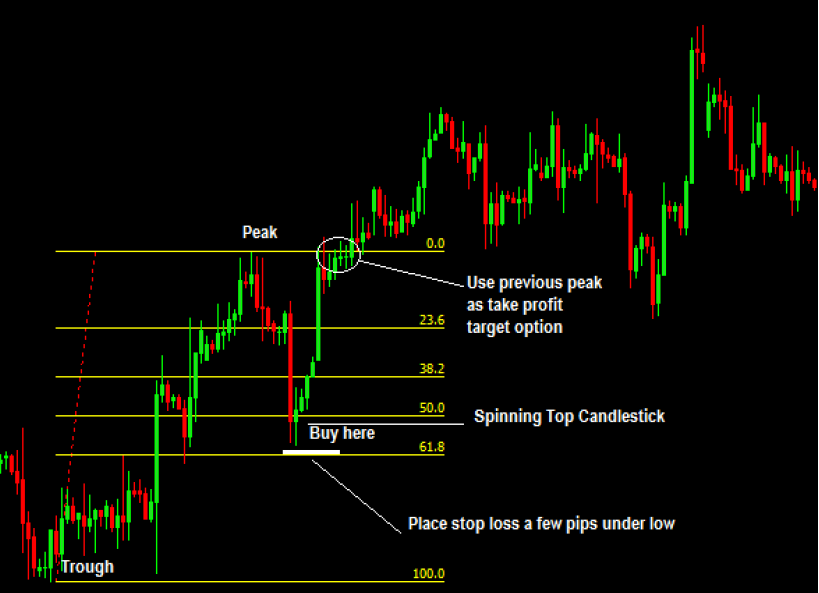

Mataki na 3b: A cikin kasuwa mai tasowa, danna kuma ja da farko a kan tudu har zuwa kololuwa kuma a saki.

Wannan shine sauƙin yadda za a zana matakan dawo da Fibonacci akan jadawalin ku.

A kan ginshiƙi da ke ƙasa lura cewa farashin ya yi kololuwa sannan ya koma ƙasa, ya sami tallafi kuma ya kafa tudu, kuma farashin ya koma sama:

A kusan matakin 50% na fib, yana fara jinkirin alamar rasa tururi na sama. Hakanan zaka iya ganin bearish kadi saman kyandir wanda za'a iya amfani dashi azaman sigina don gajere (sayar).

Can ka saya ko sayarwa kawai tushen gaba ɗaya akan lambobi na fib kamar 50% ko 61.8% da zarar farashin ya kai waɗannan matakan ba tare da aikin farashi ba?

To, ina tsammanin akwai ’yan kasuwa da ke yin hakan kuma za ku iya yin hakan. Amma ni kaina, ba na son wannan tsarin. Na fi son hada Fibonacci da juyar da kyandirori, layin yi, goyon baya & matakan juriya da sauransu don shigarwar kasuwanci.

Bari mu yi nazarin abubuwan da suka gabata… ga misalin yadda ake kasuwanci Fibonacci tare da matakin farashi a cikin haɓakawa. Lura da babban sandar kyandir ɗin da ke jujjuya daidai a matakin 50% wanda za a iya amfani da shi azaman siginar siya:

Anan ga wani misali na yadda ake kasuwanci Fibonacci tare da matakin farashi a cikin raguwa:

Ka ga wannan ba shi da wahala, ko ba haka ba? Saitunan ciniki masu sauƙi. Naku kasada kadan ne idan aka kwatanta da ribar da za ku iya samu.

Bincika Babi A cikin Kos ɗin Ayyukan Farashi

Raba wannan ta amfani da maɓallan da ke ƙasa

Wasu Rubuce-rubucen da Kuna iya Sha'awar

Yadda Ake Ciniki Matsakaici Tare da Ayyukan Farashi

Yawancin sababbin yan kasuwa waɗanda ke da wuya a ayyana tsarin kasuwa mai tasowa, [...]

Bullish Engulfing Tsarin Dabarun Kasuwancin Forex

Ɗaya daga cikin fasaha mai mahimmanci a matsayin mai ciniki na forex shine ikon iya gano alamun juyawa lokacin da [...]

Samfuran Chart Mai Riba Kowane ɗan kasuwa Ya Bukatar Sanin

Akwai bambanci tsakanin tsarin ginshiƙi da tsarin kyandir. Alamar ginshiƙi ba ƙirar kyandir ba ce kuma ƙirar alkukin ba sifofi ba ne: Chart [...]

XM Broker Review (2024) Duk Abin da kuke Bukatar Sanin ☑️

Wannan bita na dillali na XM yana bincikar wannan dillali na forex da aka tsara sosai tare da sama da miliyan 5 farin ciki [...]

Ciniki Tsararren Lokaci da yawa

Mene ne Multi-timeframe Analysis Multiple lokaci frame ciniki shine tsarin nazarin guda [...]

1. Gabatarwa Zuwa Ayyukan Farashi

Menene Kasuwancin Ayyukan Farashi? Ayyukan farashi shine nazarin farashin forex biyu [...]